As the Fed Stands Pat – and Money Stays “Parked” – Get the Jump With These Five Moves

You don't need to sit on the sidelines to build wealth ...

Federal Reserve Chair Jerome Powell and his band of policymakers at America’s central bank yesterday opted to keep the benchmark Fed Funds rate at a 23-year high – conceding that their battle against inflation had stalled.

The “non-move” was expected.

This will keep – and potentially grow – the money parked on the sidelines, as retail investors wait until the “all-clear alert” gets sounded … and the Fed gets around to cutting rates.

Less than a month ago, retail money-market fund levels hit a record of $2.49 trillion, bringing the total money piled into these funds at $6.1 trillion.

The “odds” (according to CME’s FedWatch Tool) suggest the earliest rate cut will be in September – and even that’s not much more than a coin flip, with a 43.6% chance of rates holding steady.

While some folks think they are being “financially savvy” by sitting on the sidelines, history shows that move turns you into a Wealth Killer.

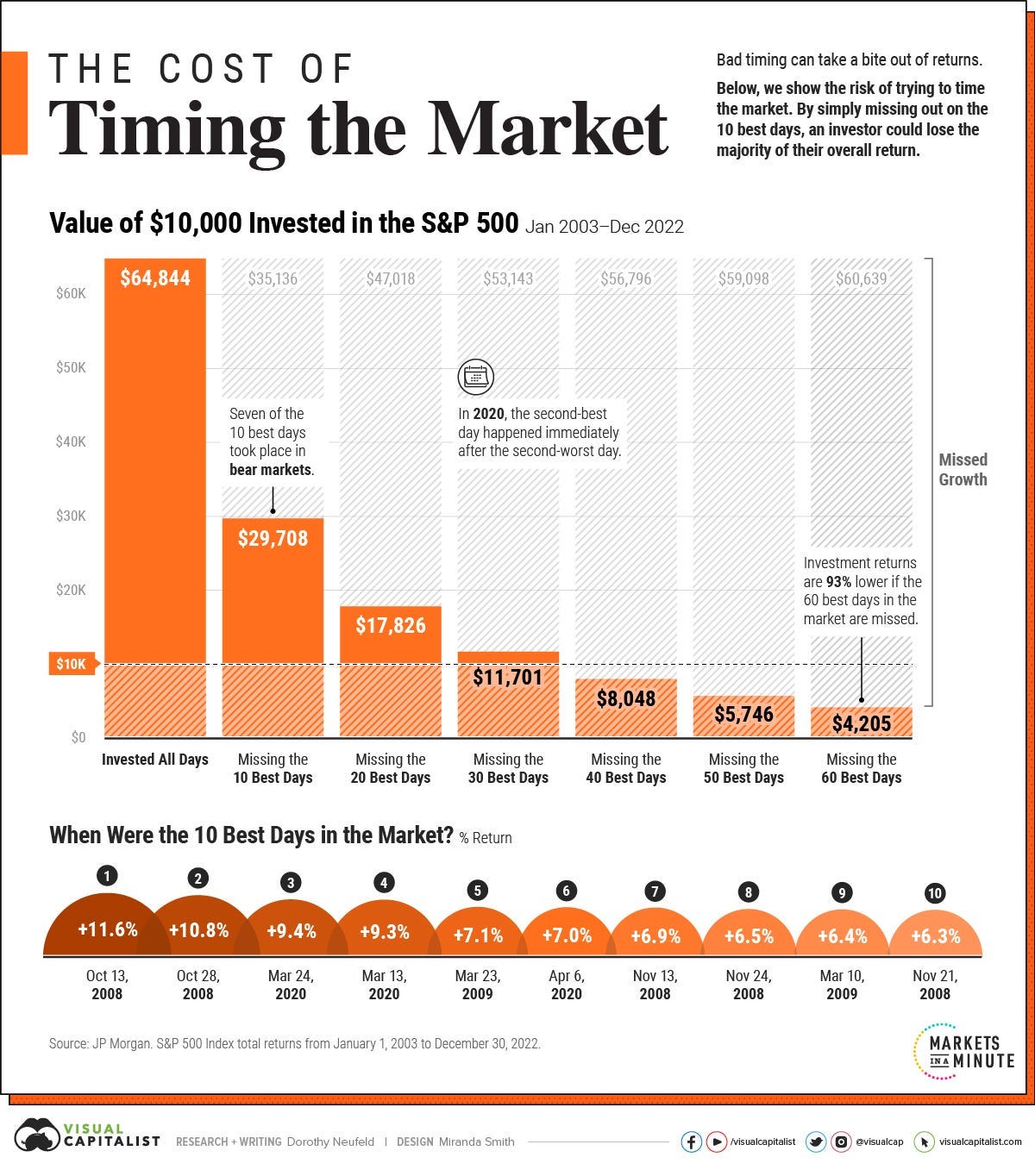

Just check out the chart below from Visual Capitalist:

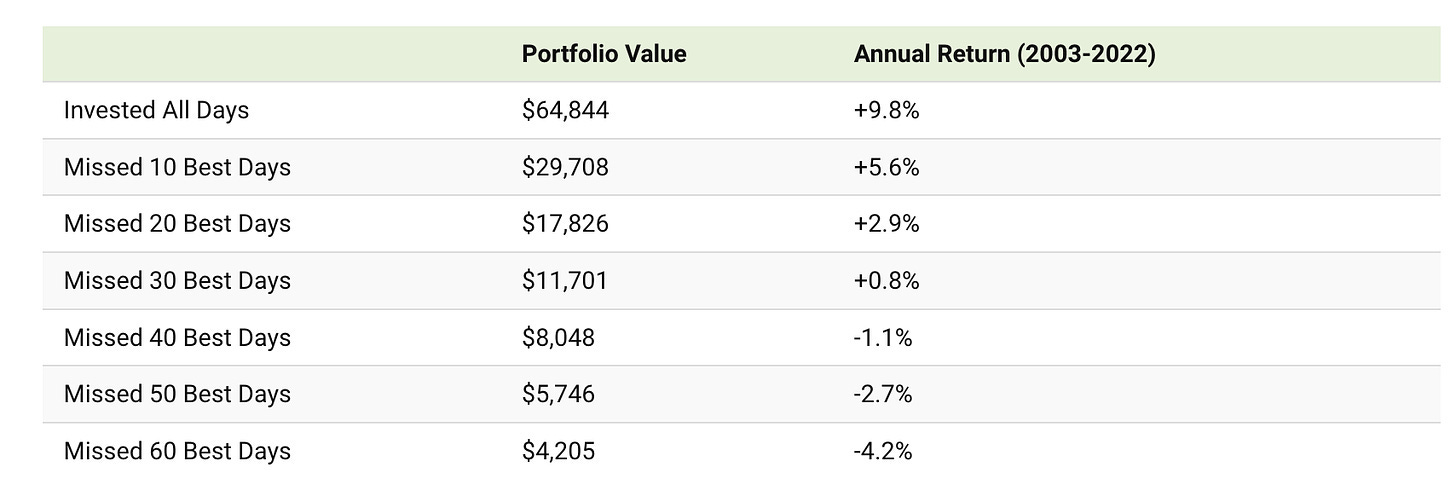

The annual returns show that from 2003 to 2022, missing just the best 40 days of the market meant you lost money:

Now, staying invested also doesn’t mean making wild bets and buying shares of just any company.

Bill Patalon looks at long-term storylines and looks at what he wants to be buying.

Here are five the Chief Stock Picker has outlined at Stock Picker’s Corner (SPC):

The AI Era, which is more than just chipmakers. One company mentioned: Blackstone Inc. BX 0.00%↑.

Essential Income, which demands a “bottom-line,” cash-flow mindset for high-yield wealth plays. One true “passive-income” play mentioned: Annaly Capital Management Inc. NLY 0.00%↑.

Special Situations, which include spinoffs and opportunities in silver and copper.

The New Cold War, which intersects with AI and Special Situations, is helping drive deglobalization, and which will drive hefty opportunities in drones, cybersecurity, defensive weaponry and more.

The New Biotech, which will be defined by the Next Blockbusters, personalized medicine, AI and datanomics and consolidation. Among the beneficiaries he’s talked about are the new class of GLP-1 weight-loss drugs being marketed by companies like Novo Nordisk NVO 0.00%↑ and Eli Lilly & Co. LLY 0.00%↑, and the leading “Pet Biotech” Zoetis Inc. ZTS 0.00%↑.

He's looking at several other powerful storylines, too.

To make sure you never miss an update from Bill on these storylines and the way to profit, you can follow along here.