Better Stock Pickers Than Mom and Dad

Also inside: Walmart’s inside scoop on weight-loss drugs and shopping habits and the importance of owning a cybersecurity ETF.

In this issue of Investing Daily Dose (IDD):

It’s never too early to teach kids about money.

The Walmart skinny on weight-loss drugs.

The best way to invest in cybersecurity.

Dose No.1: The Rise of Custodial Investing Accounts

What’s Happening

✅Custodial investing accounts at Charles Schwab jumped 150% from 120,000 in 2019 to more than 300,000 in 2023.✅

Why It Matters

🧠Time is your biggest edge when it comes to wealth-building success.

In other words, the earlier you start, the greater the result. With that longer horizon, you’ve got more time for your money to compound, more time to neutralize your mistakes (which we all make), and the more cash you can feed into your portfolio.

According to a “first-time investors” study by Janus Henderson, men start to invest at an average age of 35, while women move earlier – at an average age of 32.

But what if you got an even earlier start? In your 20s … in your teens … or even before that?

That brings us to “custodial accounts,” which parents or grandparents can open for a child or grandchild who’s a minor. The account creator also controls it but can use it as a “teaching” vehicle – walking through the investments as they’re made … so when the child or teenager reaches the age of majority (18, 21 or 25, depending on the venue) and gets the money, they understand the “what to do next.”

For those kids, the “investing math” is a massive competitive advantage.

If you invested $10 a week for a child at birth, and assumed an 8% return, you’d be looking at a $20,000 nest egg when the beneficiary is 18, says investing app Stash.🧠

Bill’s Investing Takeaway

💰“This ‘financial literacy’ storyline is a personal hot button for me … when my son Joey was 12, I put a few thousand dollars in a custodial account, sat him down, and said: ‘We’re going to get you started investing, and we’re going to do it together.’

I made sure to personalize it a bit, by talking about things he liked and used and was interested in. He loved xBox and Minecraft, so we bought some Microsoft Corp. MSFT 0.00%↑. He loved his iPad and iPhone and iTunes account, so we bought Apple Inc. AAPL 0.00%↑ . He was a devotee of Netflix Inc. NFLX 0.00%↑, so we bought that. His favorite food was mac & cheese, so we bought some Berkshire Hathaway (BRK. A, BRK.B), which owned Kraft Heinz.

I grant you: It was only a few shares of each stock … but making money (which he certainly has) was only part of the goal: I also wanted to sensitize him to money, the economy, investing and the markets.

That’s worked. He’s now a junior in high school. He signed up for a business class that was offered. He has a part-time job, and speaks intelligently about money. He has a working understanding of inflation. He’ll often comment about headlines or announcements made by the companies he invested in.

Joey is by no means an expert … but that’s okay: We’ve ‘sensitized’ him about financial issues … meaning he’ll pay attention as he gets older, goes off to college and moves out on his own.

Parents need to give their kids that kind of foundation.

One interesting aside. When I first did this, I wrote about it in my previous newsletter, Private Briefing. I was surprised by the number of co-workers – colleagues of mine at a financial publisher in their 20s, 30s and 40s – who said they’d read my column … and wondered if they should start investing for themselves this way.

It’s never too late to invest, and starting at any age is better than doing nothing at all, but the younger you start … the bigger the back-end-bang you reap.”💰

Dose No.2: Walmart’s Insider Weight-Loss Data

What’s Happening

✅Walmart Inc. WMT 0.00%↑ has a ringside seat – and proprietary data – on how weight-loss drugs are changing shopping habits.✅

Why It Matters

🧠There’s a lot of speculation on if – or how much – the new class of GLP-1 weight-loss drugs will impact the food industry – from snack-food providers, fast-food players, grocery stores and more.

Walmart is getting an early look at the potential fallout.

The megaretailer is using its data-mining chops to analyze the shopping habits of folks who use its pharmacies to pick up prescriptions for drugs being used for weight loss such as the Novo Nordisk NVO 0.00%↑ offering Ozempic.

Saying it performed anonymized comparisons of shoppers getting weight-loss prescriptions at Walmart to similar shoppers who didn’t get prescriptions at its stores, the retailer came to a concrete conclusion: Weight-loss drugs are making folks buy less food.

Without being specific, Walmart U.S. CEO John Furner said “we do see a slight pullback in [the] overall basket. Just less units, slightly less calories.”🧠

Bill’s Investing Takeaway

💰“We’re still in the earliest innings with these new weight-loss drugs. But awareness is climbing, demand is rising and sales are growing.

The drugs already have several uses … for diabetes and weight loss … and we can expect to see expanded ‘indications.’

It’s absolutely the kind of ‘Wealth Builder’ opportunity we’re interested in.

While Novo’s Ozempic is not approved as a weight-loss drug, a 66% sales jump (from $8.4 billion in 2022 to $14 billion in 2023) is evidence of off-label prescriptions. Ozempic can be covered by insurance, while WeGovy, Novo’s weight-loss version, cannot. So off-label prescriptions are easier with Ozempic.

Eli Lilly & Co. LLY 0.00%↑ got approval for Zepbound back in December. That company’s drug, Mounjaro, for both weight loss and diabetes, raked in $5 billion in its first full year.

This biotech storyline is worth watching, too, for the ripple effects we’ll see. Some of those effects will take shape as additional opportunities.

Others will materialize as new threats to sector leaders.

This is a storyline we’ll be following for you at IDD … closely and carefully.”💰

Dose No. 3: From Prescriptions to Cops, the Cyberthreat Is Bigger Than You Think

What’s Happening

✅Cyberattacks are on the upswing – but aren’t all making headlines.✅

Why It Matters

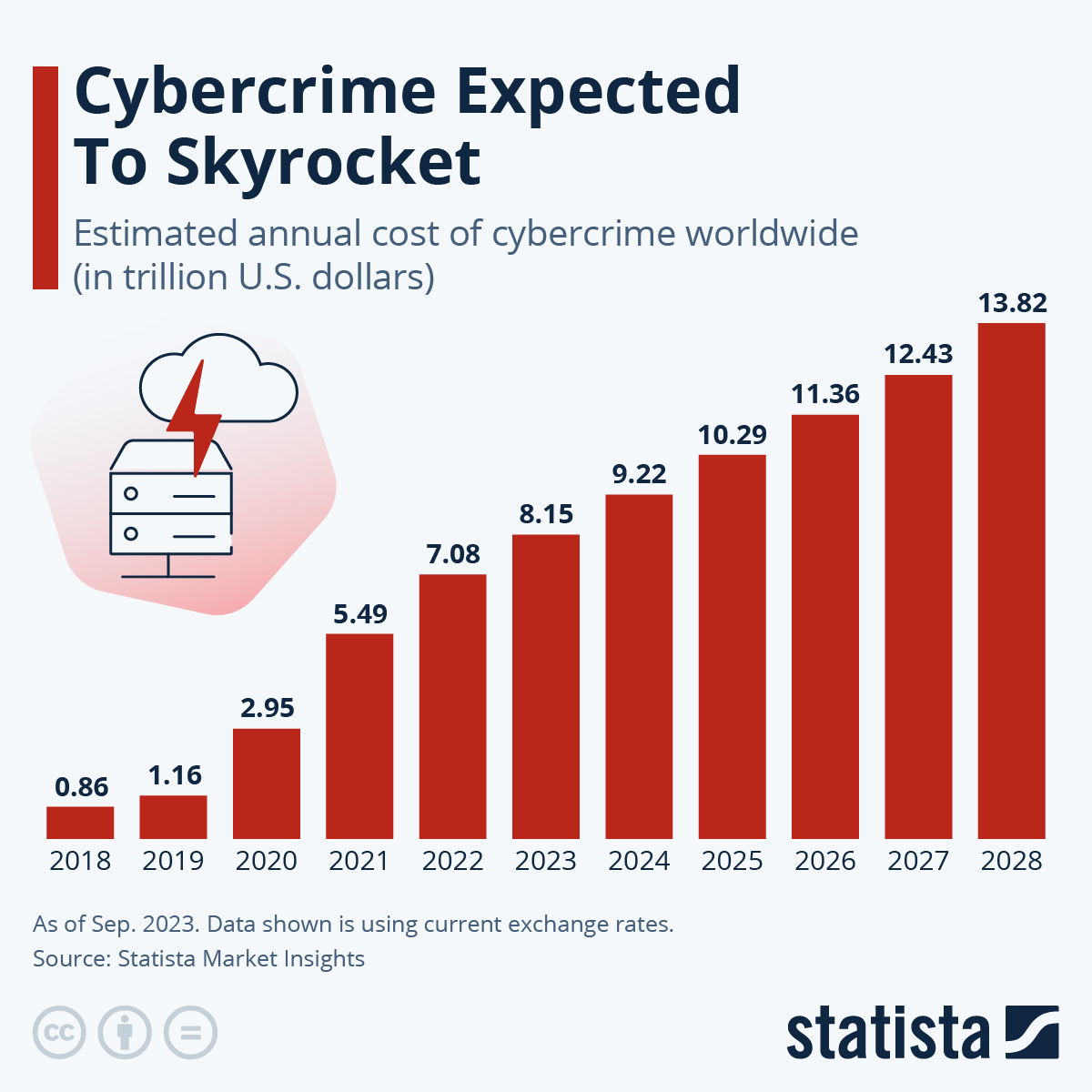

🧠According to a brand-new report from Statista Market Insights, the cost of cybercrime will surge from an estimated $9.22 trillion this year to a projected $13.82 trillion by 2028. It’s a cost issue, and it’s also a national security issue – as state-sponsored hackers go after companies, government agencies, our healthcare and so-called “infrastructure” – like our water systems and electrical grid.

Last week, in our preview of what we were watching for this week, we shared the increase of cyberattacks across North America.

UnitedHealth Group Inc. UNH 0.00%↑ and its subsidiary – Change Healthcare– were hit by a cyberattack that made it impossible for thousands of American customers to get their prescriptions filled on February 21. (The issue appears to be ongoing as of this writing.)

Change Healthcare handles the payments and processes prescriptions across the country.

Lots of customers found themselves facing this really tough decision: Do I pay for this medicine I need out of my own pocket … or do I wait until this gets fixed so my healthcare plan will pay the bill like it’s supposed to … even if waiting puts my health at risk?

There’s no melodrama intended.

CNN detailed the plight of a 32-year-old Detroit social worker who needed Paxlovid, a drug that treats COVID-19 patients who are at high risk of getting a severe form of the virus. The social worker (in effect) had to ask herself: “Do I spend $1,600 out of my own pocket for this medicine? Or do I roll the dice and hope I don’t get sicker … and wait for the system ‘fix’ that’ll have it get picked up by my insurance plan?”

In its filing with the Securities and Exchange Commission, UnitedHealth said the attack was launched by a “suspected nation-state” — one associated with cyberattacks like this one.

And this isn’t a “one-off” story. The Royal Canadian Mounted Police (RCMP) and the U.S. Justice Department (DOJ) each reported cyberattacks of their own.

The information from the RCMP is limited, but ABC reports the February 23 cyberattack on the police force of my neighbors to the North was of an “alarming” magnitude. The DOJ was open in blaming China-sponsored players for its attack.

It’s worth noting: The COVID-19 Pandemic actually spooled up the cyberattack potential because America’s workers shifted to a “work-from-home” mode that has continued to this day. So we’re all now using smartphones, laptops, iPads and networks that our employers can’t as easily police.

As that Statista report says, the pandemic “led to many organizations facing more cyberattacks due to the security vulnerability of remote work as well as the shift to virtualized IT environments, such as infrastructure, data and network-cloud computing.”🧠

Bill’s Investing Takeaway

💰“I spent a hefty slice of my time as a nationally known reporter covering stories related to the ‘first’ Cold War, which ended in 1991.

With a militant Moscow and an increasingly flinty Beijing underscore that we’re deep into a New Cold War. And this version includes a new ‘battlefield’ — cyberspace.

The New Cold War brings new ‘rules’ and new threats to understand, creates new risks to avoid … as well as new opportunities to study and understand.

One of those opportunities is First Trust Nasdaq Cybersecurity ETF CIBR 0.00%↑.

This ETF holds 32 companies that build, implement and manage security for public and private networks, computers – and for those mobile devices that are like ‘entry points’ for cyberattacks.

The top holding is chipmaker Broadcom Inc. AVGO 0.00%↑, a company that I like a lot personally. Broadcom provides cybersecurity and private cloud infrastructure, as well as data-center storage and security solutions for both investment banking and corporate banking.

This ETF is intriguing on a couple of levels.

First, it’s easily outperformed the S&P 500 over the past five years:

Second, as we saw from the holdings, it invests in cybersecurity – but not in the strictly defined ways you think.

And third … I love the ticker: CIBR. (Apologies, couldn’t resist).

Look, over the past decade or more, the cyber threat has evolved into another branch of global militaries … so it’s not going away.

Companies that can blunt this growing threat will remain in demand.”💰