In this issue of Investing Daily Dose (IDD):

👑Dividend Royalty Snapshot of the Week No. 1👑

This week, we’re featuring “snapshots” of three Dividend Aristocrats in the ProShares S&P 500 Dividend Aristocrats ETF NOBL 0.00%↑ because of the new “passive-income imperative.”

It’s true that inflation is “cooling”compared to the summer of 2022.

But you really need to understand what that means. Cooling inflation just means prices aren’t rising as quickly as they were.

But they’re still rising, still high – and will likely stay that way.

It’s been three decades since Americans have spent this much of their paychecks on food. And rent, electricity, insurance and gasoline have all risen faster than our wages over the past four years. So this higher-priced world is something we all must navigate. And one way to do this is with a passive-income vehicle that will actually grow your yield over time.

That rising yield will help offset those higher prices now – and the increases that will keep coming.

NOBL is a great foundational play for a passive-income strategy. It’s filled with Dividend Aristocrats – companies that have raised their dividend payouts for 25 consecutive years.

Most companies that achieve this level of “income nobility” make things that folks will always buy … like paint … or glue … or tape. They have brand names that people like and trust.

So the ETF is a good starting point.

But one of our core beliefs here at IDD is that your biggest total returns will be made through owning individual stocks.

That’s why we went “under the hood” – looking at the specific holdings within the S&P 500 Dividend Aristocrats ETF – to spotlight a few individual stocks for you to put on your research list.

Let’s start with the first one of the week.

Stock: AbbVie Inc. ABBV 0.00%↑

Founded: 2013 (Spun-off by Abbot Laboratories ABT 0.00%↑)

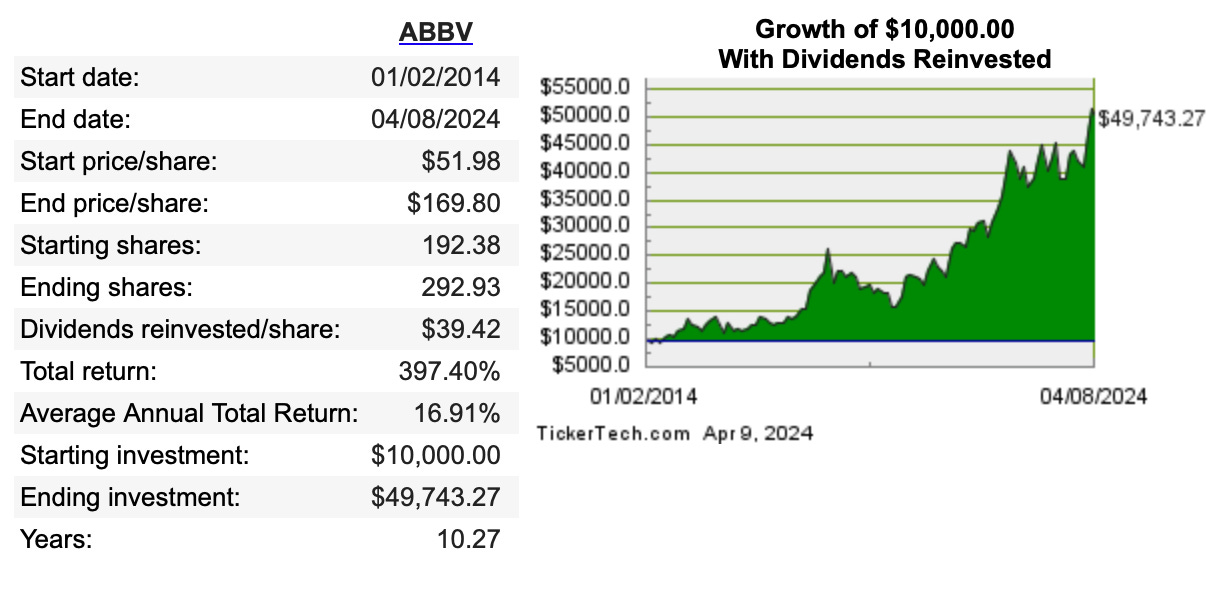

10-Year Average Stock Price Gain: 16.91%

Dividend & Yield: $6.20 (3.44%)

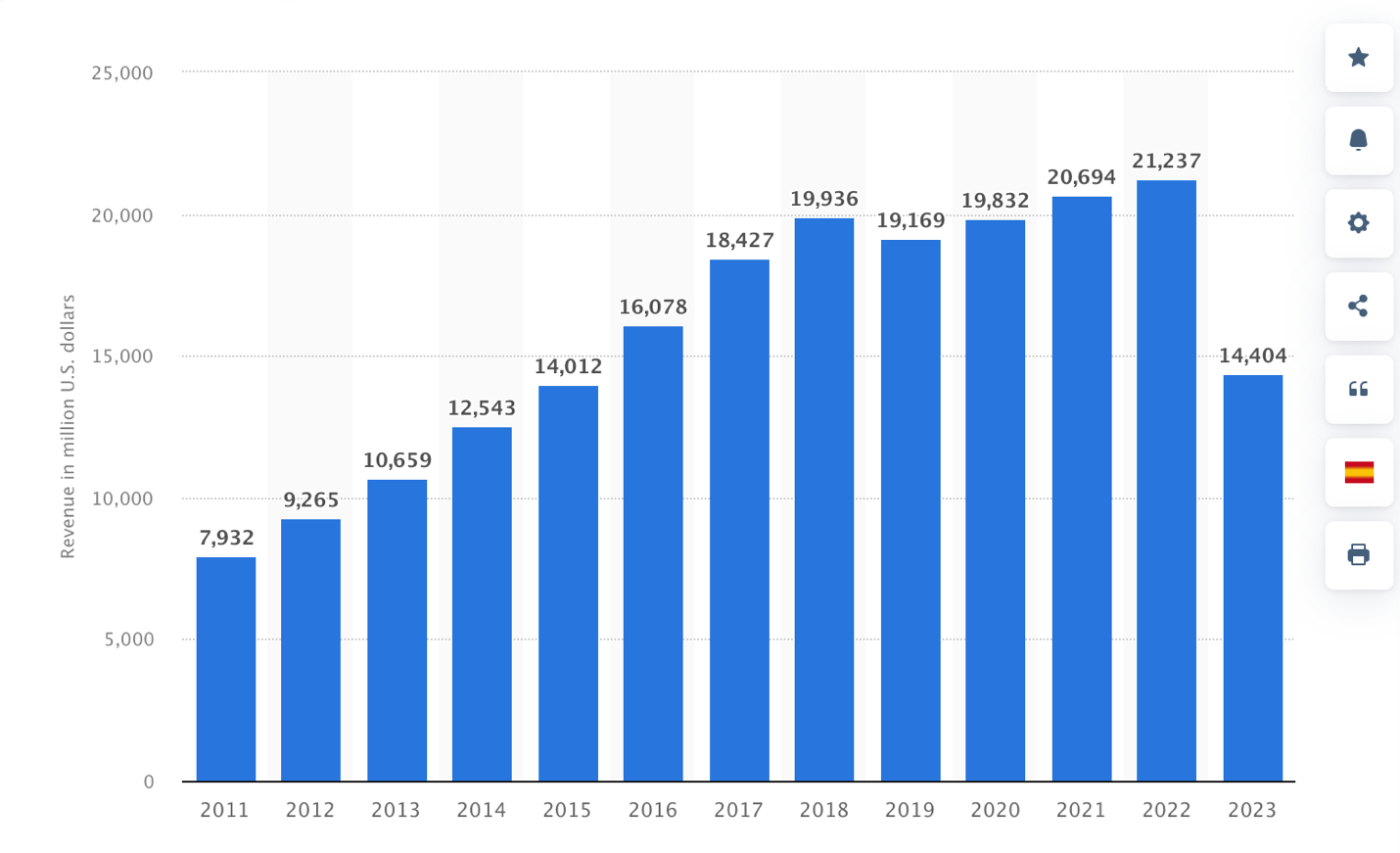

AbbVie’s Humira – a treatment for inflammatory diseases like arthritis – was a “Blockbuster” for the company and hauled in $16 billion or more for seven out of the last eight years:

But U.S. sales nosedived last year because Humira’s patent protection ended, allowing nine competitors with similar products to enter the market.

For 2024, AbbVie warned of even more slumping Humira sales as a result of less insurance coverage across the United States.

Watching a “Cash Cow” start to dry up is a weakness that could turn into a threat for AbbVie.

But AbbVie’s management isn’t standing pat: They are being proactive about the issue with some newer “lineup additions,” including:

Skyrizi – used to treat Crohn’s disease, plaque psoriasis and psoriatic arthritis.

And Rinvoq – used to treat moderate-to-severe rheumatoid arthritis.

Together these drugs are expected to generate $16 billion in sales in 2024 and $27 billion by 2027.

Abbvie’s 2023 acquisitions of ImmunoGen Inc. and Cerevel Therapeutics are also expected to “replenish” Abbvie’s all-important drug pipeline, Bloomberg says.

ImmunoGen has a pipeline of cancer and tumor-treatment drugs in various clinical phases, while Cereval’s pipeline is filled with treatments for Parkinson’s, mood disorders and schizophrenia.

That’s all promising.

But when you’re investing, you want to be as tough as possible on any investments you’re looking to make – you don’t want to be a Wealth Killer.

In biotech, it’s the “Biotech Math” that makes a stock like AbbVie more suited for those with moderate or higher risk tolerances.

Here’s what we mean:

1. It takes more than a decade and as much as $2.6 billion to develop a new drug.

2. On average, only about 250 drug candidates out of 5,000 to 10,000 make it from the researcher’s bench to preclinical testing – and only one or two make it to market approval.

3. Fully 90% of drug candidates that actually make it into clinical trials fail to make it through the three-stage U.S. Food and Drug Administration process for market approval.

4. Once a drug achieves approval, gross margins can exceed 90% – albeit not forever.

5. These pharma creators only have 20 years of patent protection for a drug – half or more of it gets eaten up by development and approval. (After which generic contenders can drain away 90% of sales.)

Bottom Line: AbbVie seems to have a plan in place to replace Humira, but it’s all about execution. It could find a new “Blockbuster” in its growing pipeline, but as you saw from the “Biotech Math,” there could be a lot of time and money sunk into developing treatments that never see the light of day. While investing is always about “what comes next,” history can serve as a guidepost. Over the last 10 years, AbbVie shares have had an average yearly return of nearly 17%. And being that the purpose of this snapshot is income opportunities, AbbVie pays a dividend of $6.20 – a solid yield of 3.44%.

We’ll be back tomorrow for our next snapshot: It’s a well-known retailer employing a sneaky strategy that Amazon.com Inc. AMZN 0.00%↑ used to haul in $47 billion in revenue in 2023.

See you then.

Do you know someone who would benefit from today’s issue?

Feel free to share it.