Sam Altman – And America’s $7 Trillion Semiconductor "Treasure Hunt"

Plus, Nvidia’s latest AI investment and Dunkin’s parent eyes IPO ...

In this issue of Investing Daily Dose (IDD):

💲 OpenAI CEO seeks trillions for chip-industry revolution.

💊 Chipmaker pours millions into an “AI Biotech.”

☕ "America runs on Dunkin’” ... will it run to the company’s IPO?

Dose No.1: More Chips ... Now

What’s Happening

Sam Altman, CEO of OpenAI (known for ChatGPT), wants to raise as much as $7 trillion to boost the processing power and production volumes of the semiconductors needed to run advanced artificial intelligence (AI) chips.

Why It Matters

Altman is the magnetic yet unpredictable face of the AI Revolution.

And he’s impatient - for good reason.

The CHIPS and Science Act (nicknamed the “Chips Act”), signed on August 9, 2022, authorized a $53 billion investment in the U.S. semiconductor industry for production, R&D and work-force expansion. While the White House claims companies have since announced $231 billion in chip/electronic-related projects – and 50 community colleges in 19 states have unveiled new or boosted chip-focused programs – The Wall Street Journal reported that only “two tiny grants” were made among 170 firms that applied for federal CHIPS Act-related grants around the time Altman made headlines.

And both those grants were for “less advanced chips,” the newspaper reported.

As Altman sees it, that’s not nearly enough – in timing or magnitude.

And he’s not waiting around.

In a bid to raise $5 trillion to $7 trillion, the AI Whiz Kid is already meeting with Softbank Group Corp. (SFTBY) CEO Masayoshi Son, investors from the United Arab Emirates (UAE) and with executives from Taiwan Semiconductor Manufacturing Co.(TSMC).

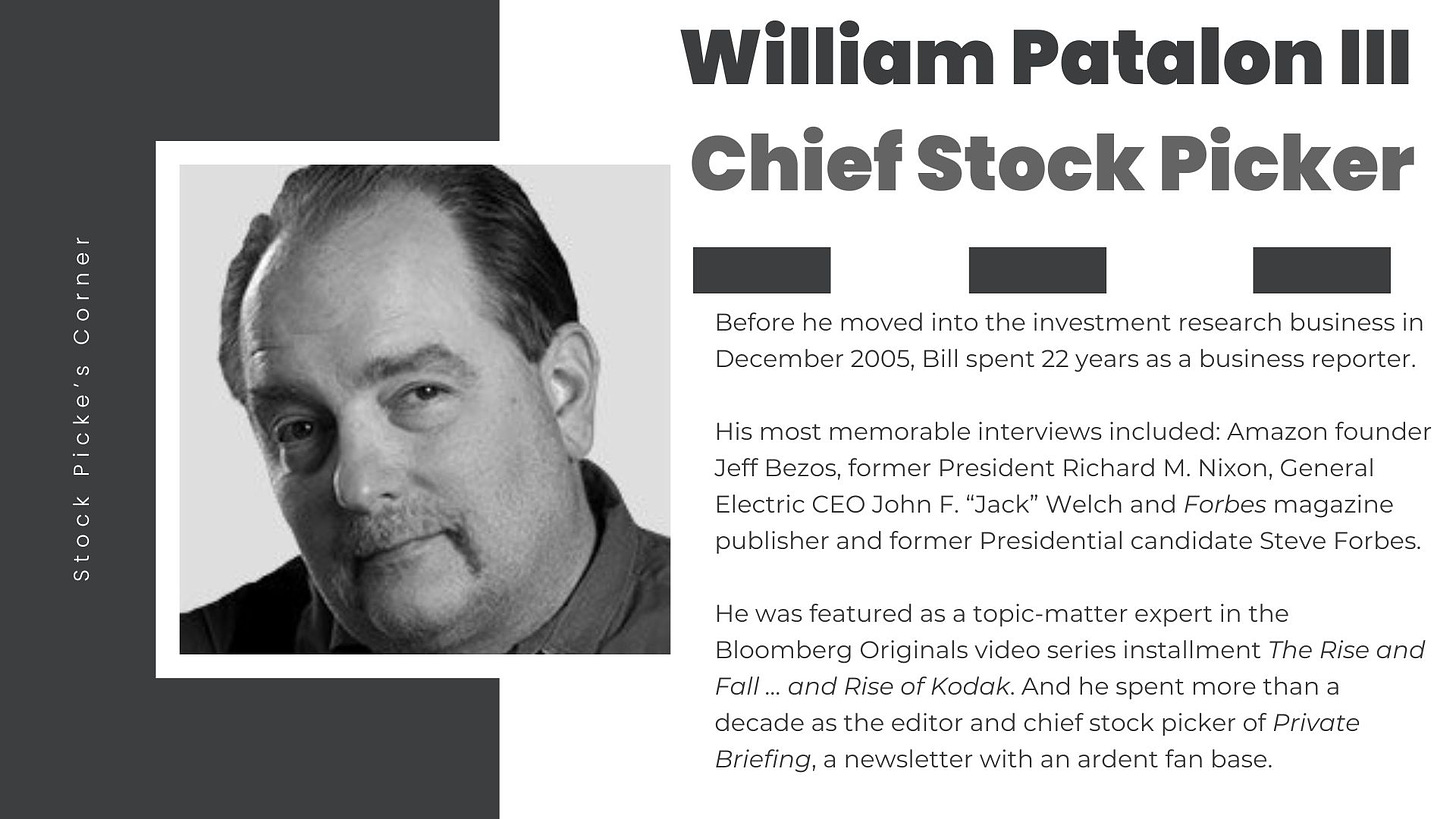

Bill’s Investing Takeaway

“I can’t underscore enough how huge a story this is … it’s not JUST about AI … it’s about U.S. competitiveness … America’s future standard of living … and our country’s security. America invented the semiconductor … and they’re the ‘brains’ of everything now.

Yet we’ve gone from producing about 40% of the world’s chips to about 10% … which makes us incredibly vulnerable … to near-term supply-chain disruptions (as we saw during the pandemic) to long-term shortages created by the deglobalization trend.

For ‘Wealth Builders’ like us, it creates a huge opportunity. The global demand for semiconductors was already slated to grow – from an estimated $573 billion in 2022 to a projected $1.38 trillion in 2029.

But the ‘AI Era’ will rev up that demand like a turbocharger on a souped-up motor. If Altman achieves even part of his goal, that will accelerate the construction of new semiconductor factories (known as “fabs” in industry parlance).

Companies like Applied Materials Inc. (AMAT) will benefit.

It’ll also jump-start dealmaking. Think about it … a fund with $5 trillion matched up with an industry that did a bit more than 10% (11.5%, to be exact) of that amount in a single year in 2022. So that could fuel consolidation and strategic alliances.

Stick around … we’ll be talking about this a lot. In fact, I’ll address this in an upcoming report on the ‘New Cold War’ in our Stock Picker’s Corner (SPC) publication.

Make sure you’re subscribed to SPC to be the first to know when it’s released.”

Dose No.2: AI as a Drug-Development Accelerator

What’s Happening

Nvidia Corp. NVDA 0.00%↑ has invested an aggregate of $76 million in Recursion Pharmaceuticals RXRX 0.00%↑.

The goal: Speed up Recursion’s AI-powered drug-discovery models.

Why It Matters

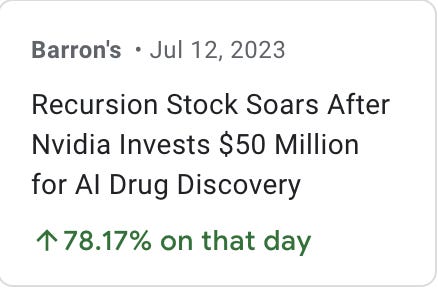

Sticking with the AI-plus-semiconductor storyline, AI-chip leader Nvidia injected an initial $50 million into Recursion in July 2023. The Salt Lake City-based Recursion is a clinical-stage biotech that believes “reshaping the drug discovery funnel” will lead to faster breakthroughs.

With its three-point approach, Recursion:

Broadens the potential use cases of a drug candidate beyond human-biased and hypothesized targets.

Identifies failures earlier in the research cycle – before the investment dollars really add up.

And speeds up the development of drug candidates, which should get new therapies to market faster and at lower costs.

With Nvidia’s first investment, Recursion’s share price posted a big, double-digit surge in a single day:

Nvidia’s latest investment in Recursion brings its total outlay to $76 million. After Nvidia announced its last investment on February 16, the Recursion stock price jumped from $12.15 to $15.46 by February 27.

It’s now sinking closer back to 12 bucks - get used to this “cause/effect” AI impact: An AI mention can trigger a big stock-price move. But there are lessons to learn from this story.

Bill’s Investing Takeaway

“We’ve reached a point in the AI cycle where the mere mention of AI – or the association of a company like Nvidia or OpenAI – can ignite a big stock price move … one that’s easy to chase.

Here, though, we’re ‘Wealth-Builders,’ not traders.

We’re taking the time to drill down, to examine the very real wealth storylines like AI is creating. Take drug development; something I know well from having followed biotech for years.

The basic piece of ‘Biotech Math’ tells us it can take more than a decade, and cost as much as $2.6 billion to develop and commercialize a new drug.

If a technology like AI can compress that time-to-market cycle – and do it safely – consumers will benefit from a wider choice of better, safer, less-expensive drugs … drug companies will face less risk and have more time to recoup their R&D outlays, meaning they’ll be more predictable and more profitable … and wealth-focused investors will be able to go along for the ride. And not just with the drug companies.

We’ll be able to invest in the ‘enabling’ technologies … with services … and more. AI is new … but the investment lessons are not.

Understand what you’re investing in. Don’t make knee-jerk decisions. And don’t succumb to the ‘dammit, I missed it’ self-recriminations.

Another opportunity always comes along.”

Dose No. 3: Coffee and a Donut ... And an IPO

What’s Happening

Roark Capital is mulling an initial public offering (IPO) for its Inspire Brands unit (the parent of Dunkin Donuts, Arby’s and Jimmy John’s).

Why It’s Important

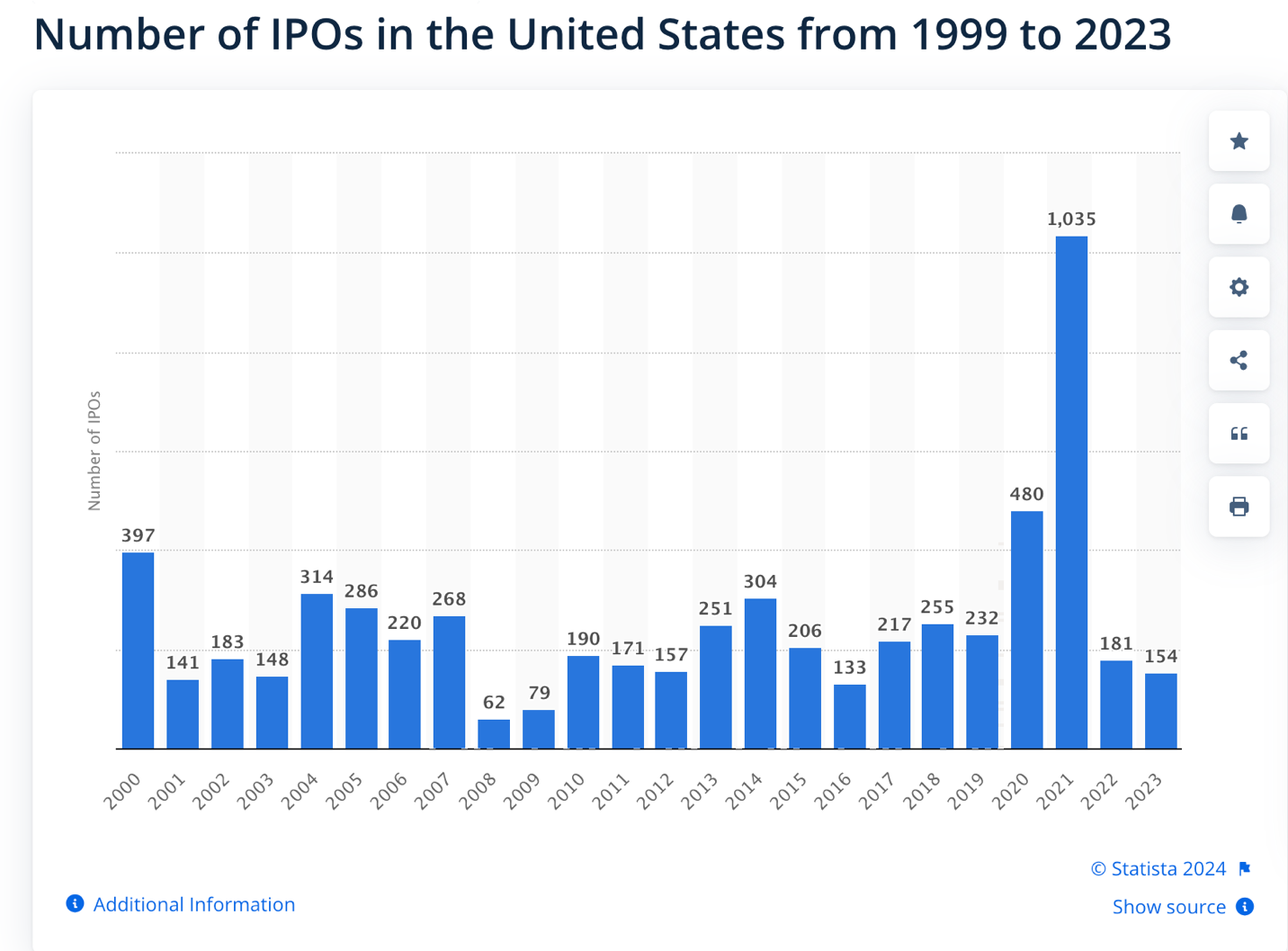

Outside of the “special purpose acquisition company (SPAC) “boom” of 2020-2021 (call it an “aberration” that skewed the IPO totals), the number of U.S. companies going public has been falling since 2018:

That’s noteworthy on a bunch of fronts. The fallout from the SPAC mess, higher-for-longer interest rates and a desultory response to the offerings that have come to market have held down new offerings.

In contrast, the right company can spark a windfall. Just ask the folks who invested in Amazon.com Inc. AMZN 0.00%↑ in 1997, as they’re up over 197,000%:

But for every Amazon, there are multiple misfires. And the number of public companies has been declining for years.

Bill’s Investing Takeaway

“For us here at IDD, this is another example of a ‘Know Thyself’ moment – you know, asking the right question.

It’s not about investing in the right IPO, it’s about investing in the right company.

Most of our focus is on powerful storylines, and the companies best-positioned to ride along and benefit. So instead of asking, ‘Hey, is this a good IPO deal?’ ... instead ask ‘Is this a company I want to own for three, five, seven or 10 years?’

A great company is a ‘Wealth Builder.’

A bad IPO deal is a ‘Wealth Killer.’

One example of what we’re talking about here is along the lines of Wingstop Inc. (WING), a buffalo-wing restaurant chain that’s got a compelling, tech-fueled growth story. It went public in 2015 at 19 bucks. Now it’s trading up around $366. (Check out our SPC report on Wingstop here.)

After the ‘SPAC Bust,’ we’re not seeing as many deals come to market. And the response to the IPOs that have debuted have often been tepid.

In general, the number of public companies available to invest in has been dropping for years. So there are fewer to choose from.

That means it’s crucial to choose ... wisely.”