In this issue of Investing Daily Dose (IDD):

🍔The New Cost of the All-American Meal🍔

American consumers would seem to have lots to be stoked about right now.

Like …

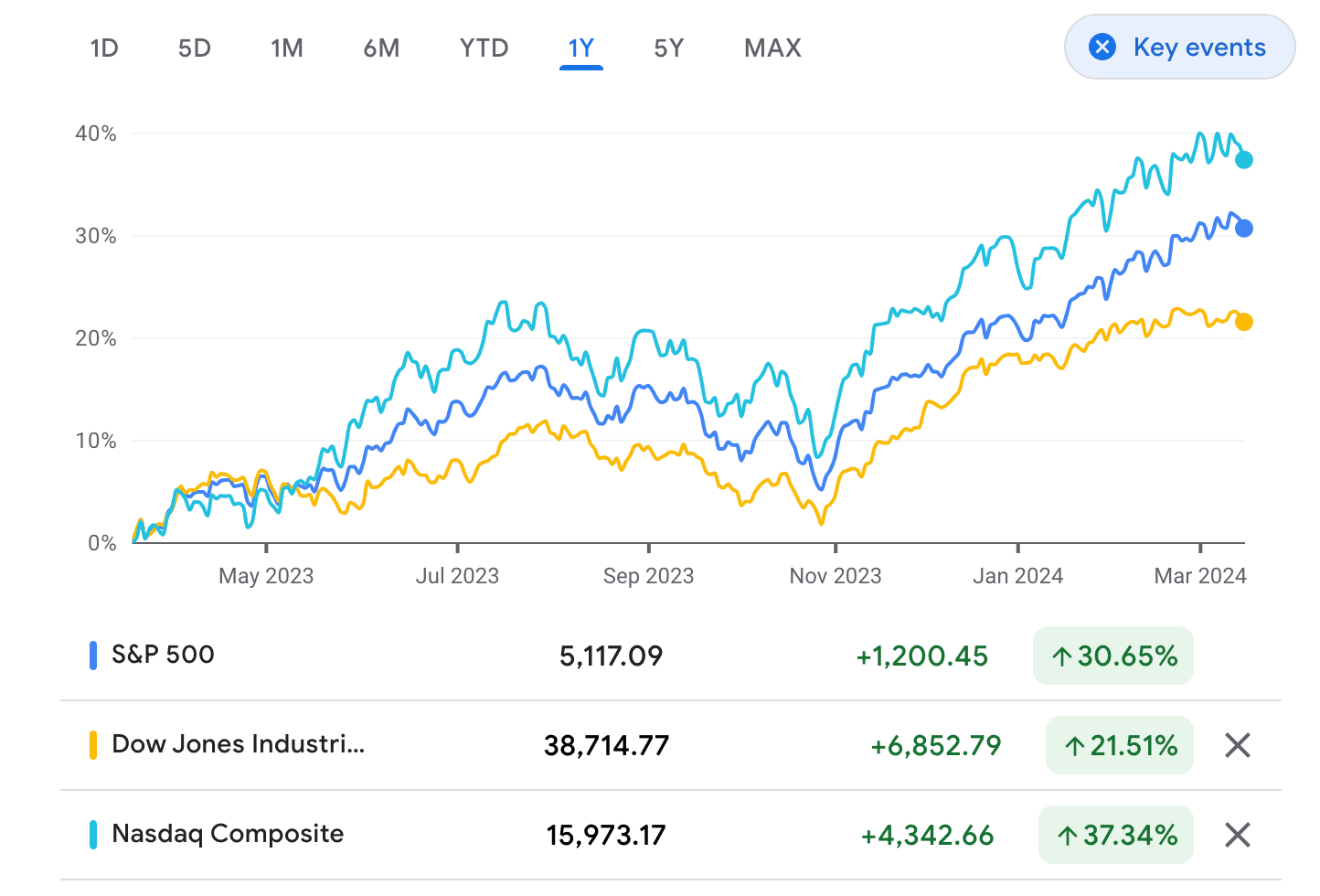

The stock market is screaming like a stock car at Daytona.

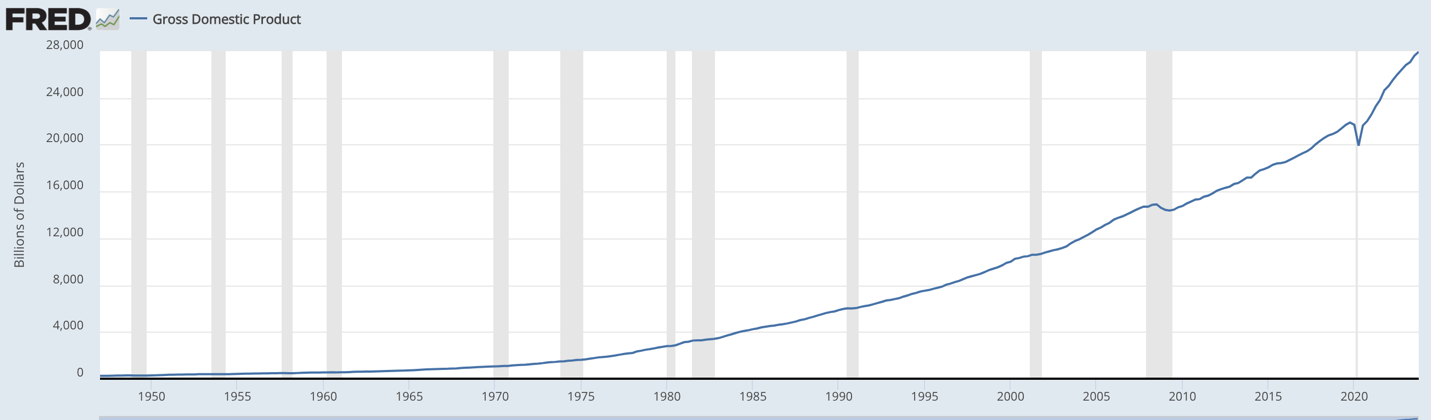

Washington and all those “official” reports tell us the U.S. economy remains strong.

Interest rates are expected to fall sometime this year.

But millions of Americans listen to that “all-is-well” official narrative – and just aren’t feeling it.

What they feel instead … is pain.

Experts are attributing that “great disconnect” between what the numbers are saying and what people are feeling due to inflation.

But we know it’s because of prices.

Cumulative prices.

How much more stuff costs today than it did in 2019, 2020 and 2021.

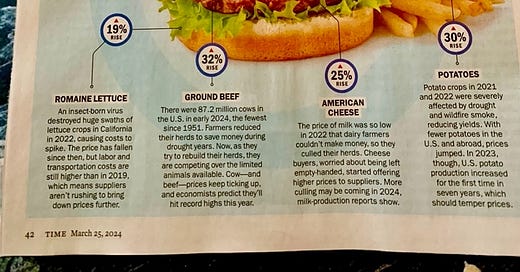

Just look at the “Why a Burger Costs More” feature in the March 25 issue of Time magazine:

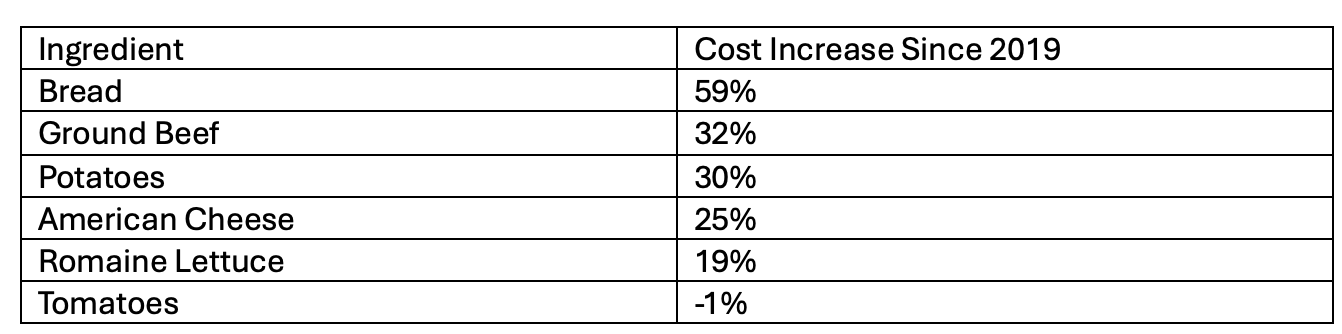

Grab your grocery list for the ingredients for the “All-American” burger-and-fries meal and you’re looking at $4.69 a serving – a full 30% more than it was in 2019.

Here’s a breakdown of those rising costs, by ingredient:

Time also notes that the increase over last year is a mere “pennies.”

That’s how Washington wants you to see it. And that’s why consumers are so angry: They remember what it cost in 2019. So they’re feeling the pain – and also feel like the Inside-the-Beltway bureaucrats are (at best) being insensitive or (at worst) trying to pull a fast one.

And price relief is nowhere in sight.

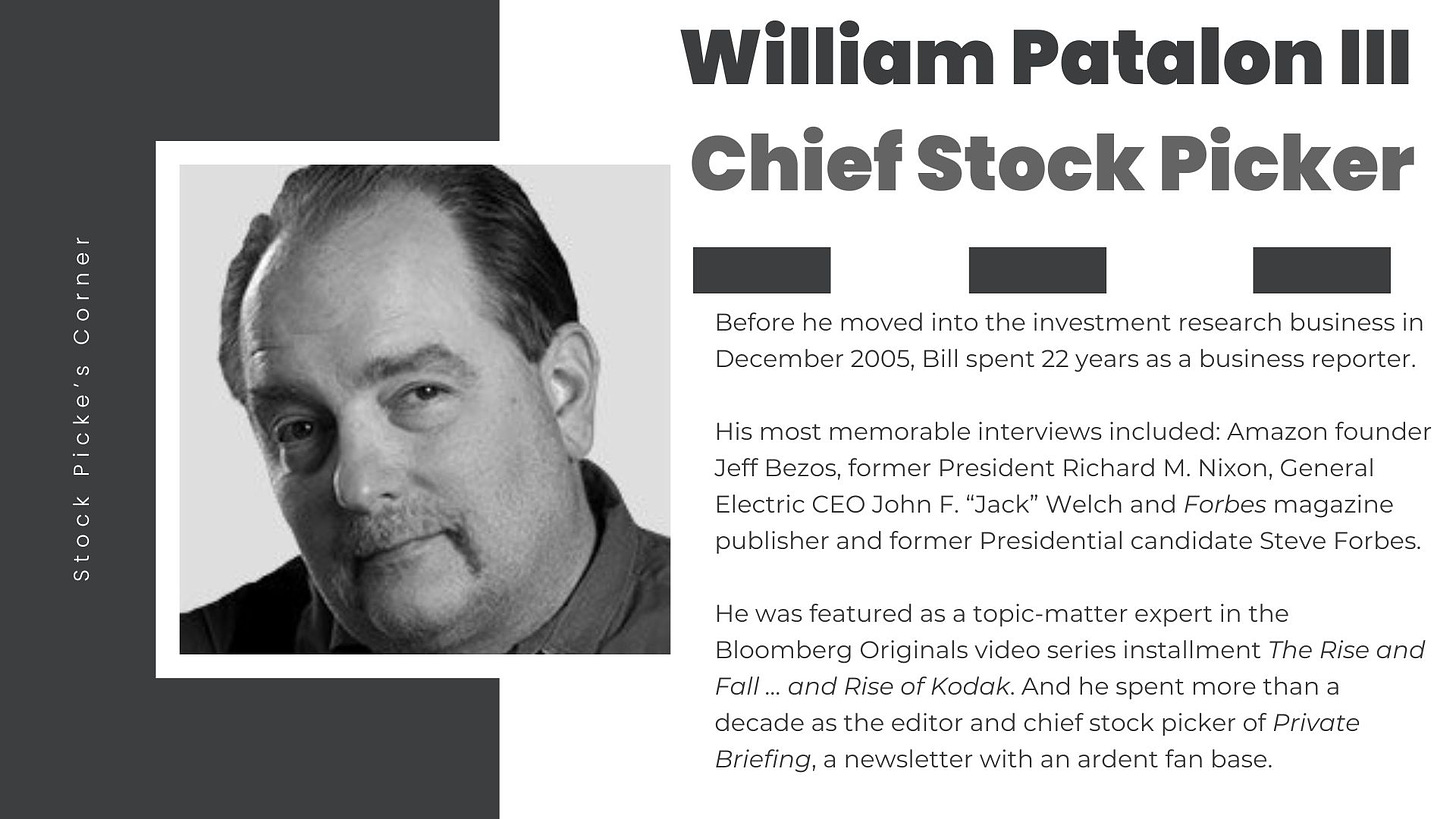

Bill’s Investing Takeaway

“I’ve seen this in my own family. I’d recently asked my Mom if she could make her vaunted tacos (she got the recipe from a neighbor in Murrysville 50 years ago, and they’re my favorite thing she makes).

At brunch a few weeks back (my son Joey and I meet her for brunch or dinner every Sunday), she ‘apologized’ for having not made them, yet. She’d gone to the store to get the ground beef, and balked at the $15 it would have cost for two pounds. (That $7.50-a-pound average was nearly 50% higher than the $5.11 national average.)

‘Everything is so expensive,’ she lamented.

We got the meat elsewhere, and she made the tacos (they’re already gone). But you get the point: The discontent is everywhere.

You can fight back – with a strategy that combines growth and income and time.

By growth … we’re talking about finding the most-powerful storylines – those with the most muscle and the longest staying power – and then digging in to find the very best opportunities.

By time we’re talking about eschewing the DraftKings-type ‘betting’ mentality that’s infected retail investors in recent years … with a growing willingness to speculate with options … and re-committing to optimal holding periods for stocks and other investments. I mean … three, five, seven even 10 years for the stuff that’s hitched a ride on the stories with the most muscle.

Then there’s income. Look for income plays that outrun taxes, market rates, inflation … and think about ‘cash flow.’ Some of that income can supplement your wages.

Some can be used in a Warren-Buffett-like way … and funneled into other stocks.

Want two examples?

Opportunity No. 1: S&P 500 Dividend Aristocrat ETF

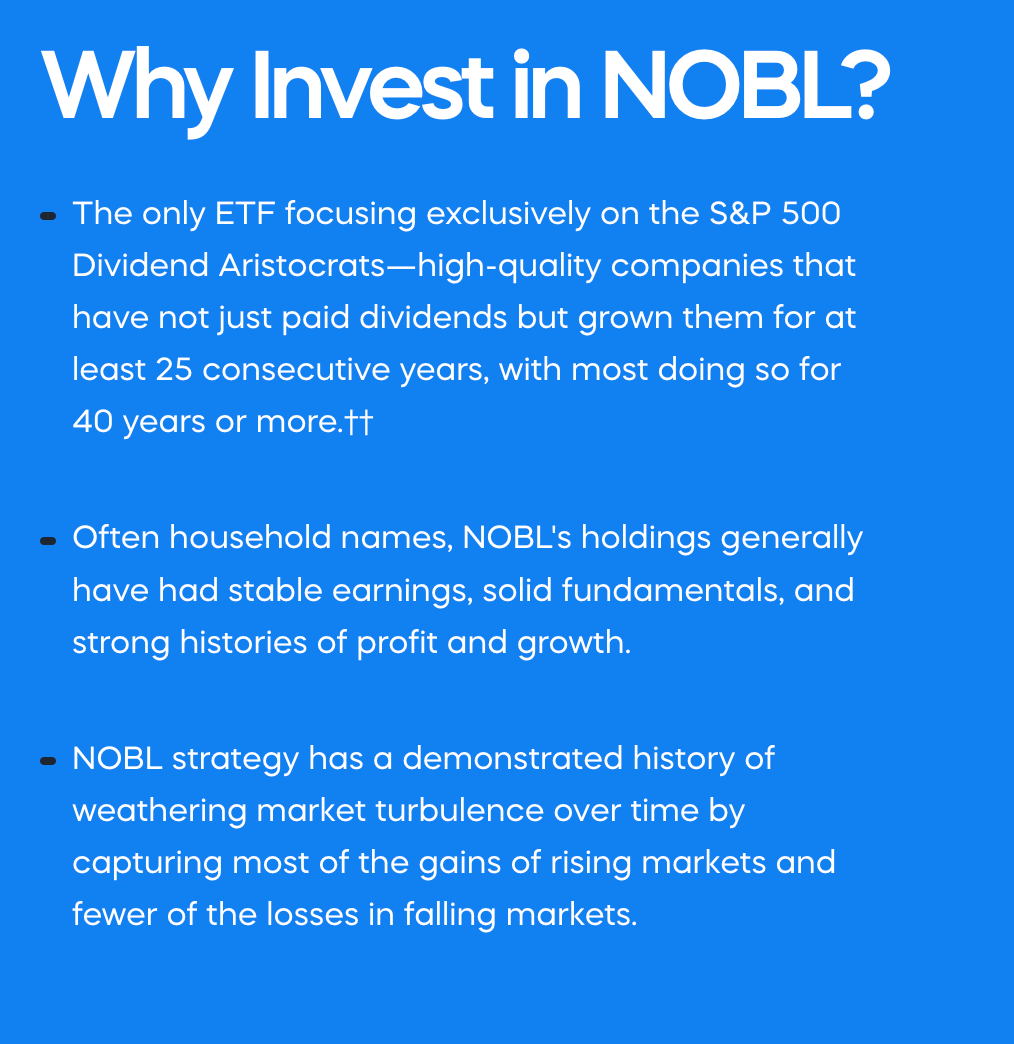

I’m a big fan of Dividend Aristocrats – companies that have raised their dividend payouts for 25 consecutive years.

And for good reason. Companies that achieve this level of ‘income nobility’ make things that folks will always buy … like paint … or glue … or tape. They have brand names that people like, trust and stick with (my accidental/on-purpose joke).

Once a company earns this moniker … management does all it can to keep it. So the business is managed to generate the cash flow required to keep boosting that payout.

Over time (there’s that term again), the ‘yield on cost’ – the yield on what you originally paid for the stock – can become quite impressive. And, since share prices over time tend to rise as the payout increases (meaning the current yield remains fairly steady), you’ll also see a share price gain. (I’ll cover both these concepts in more detail in an upcoming report at Stock Picker’s Corner.)

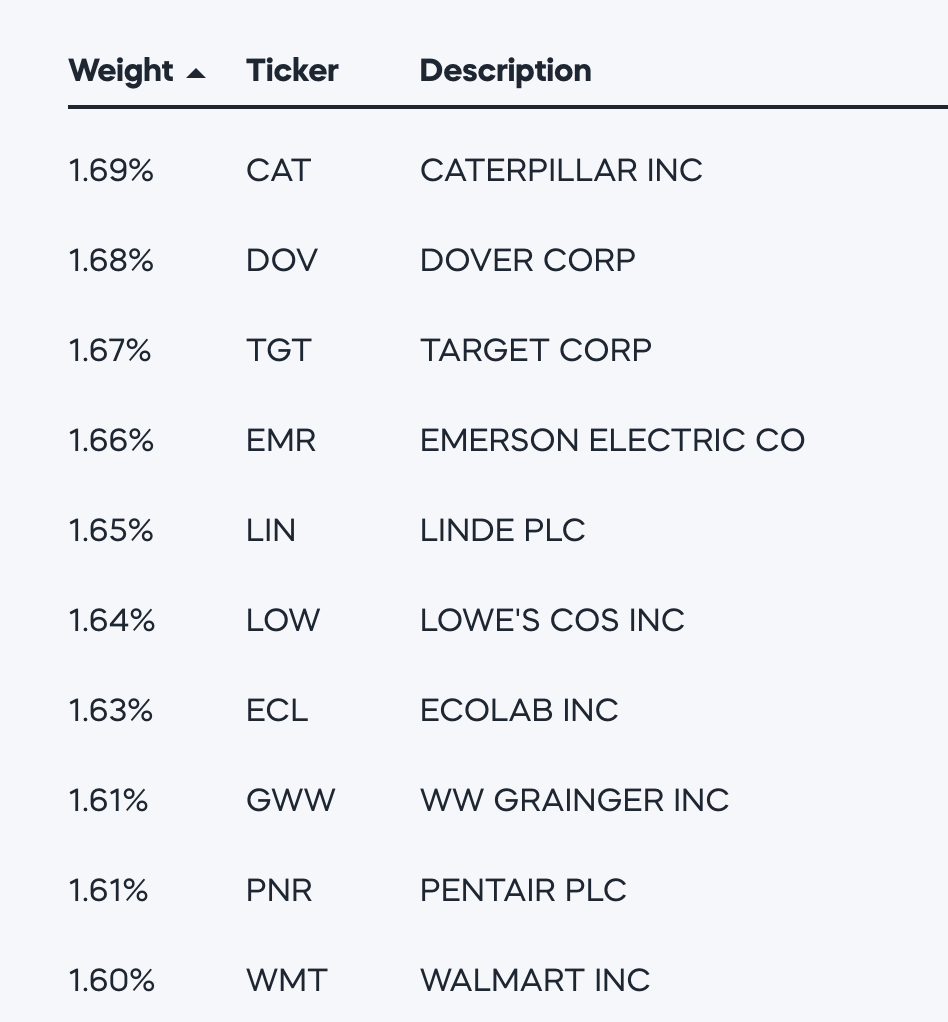

An easy way to get started: The ProShares S&P 500 Dividend Aristocrat ETF (NOBL).

Its top-10 holdings include some household names, like Target Corp. TGT 0.00%↑, Lowe’s Companies Inc. LOW 0.00%↑ and Walmart Inc. WMT 0.00%↑.

Each quarter this ETF peels off a dividend payment to shareholders, and over the last year, that payout was $1.99, with a yield of 2.02%.

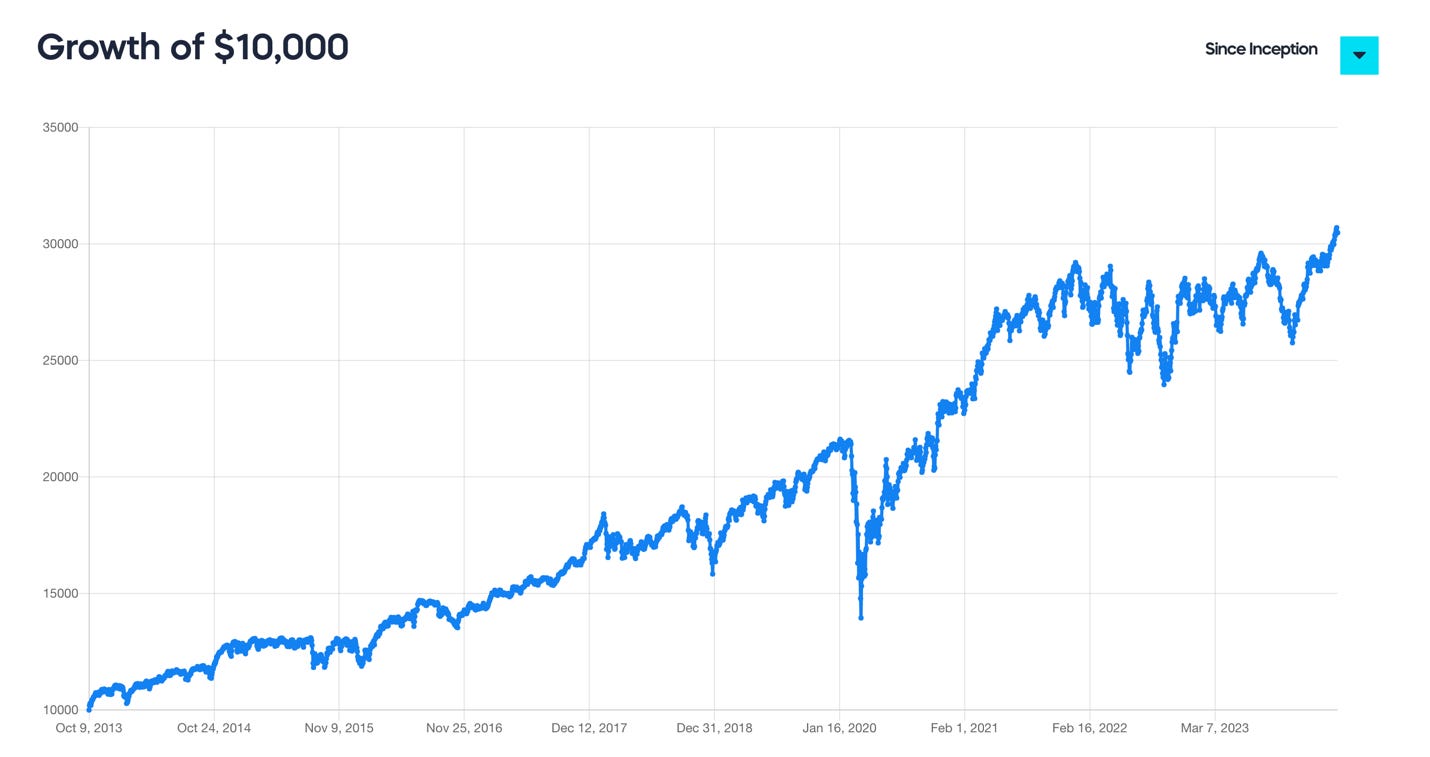

While this isn’t the highest yield out there, it’s a good first step for newer income investors. Then there’s that price-appreciation bonus. As you can see $10,000 invested since inception is now worth $30,000.

Opportunity No. 2: Ares Capital Corp.

The Los Angeles-based Ares Capital Corp. ARCC 0.00%↑ is a ‘business-development company,’ or BDC. BDCs are a type of closed-end investment firm that provides debt-and-equity financing to small- and mid-market companies.

In fact, BDCs operate a lot like private-equity (PE) or venture-capital (VC) firms. But while PE and VC firms mostly accept investments only from wealthy folks, BDC shares are publicly traded, meaning anyone can invest if they want to.

BDCs are required by law to invest at least 70% of their assets in private U.S. companies with market values of less than $250 million. And they’re required to pay at least 90% of their income out to shareholders as dividends.

The yield, liquidity offered by publicly traded shares, availability to all investors and diversified asset base are the strengths of a BDC firm. The weaknesses are that you must monitor the credit quality of what they hold (especially in a slowing or stalling economy), and you want to be cautious when interest rates spike.

Ares specializes in lending to mid-market companies. Its current market value is $12.15 billion. As of December 31, it was the largest BDC by market cap.

Ares’ current yield is 9.59%. Over the last five years, it’s had a minimum yield of 7.17% and a median yield of 9.22%, according to YCharts.

That track record as a high-yielding opportunity is why Ares is worth putting on your personal list of income investments to consider. Remember what I said about risk? The high yield — and the business model that drives it — makes for higher risk. So do your homework: Be sure the risks I’ve outlined here are a fit with your ‘know thyself’ parameters.

While the focus of this investment is income, a nice bonus is that the stock price has also climbed nearly 15% over the last year.

All in all this is part of a strategy that will let you enjoy that ‘All-American’ meal – while avoiding inflation-ignited indigestion.”

Great insights!