Last week was the biggest weekly loss for stocks in 17 months.

Heck, even the “invincible” Nvidia Corp. NVDA 0.00%↑ (aka “The Poster Child For AI Stocks”) suffered its single worst day since March 2020.

The trigger?

A scary stew of stubborn inflation mixed with a strong economy that’s certain to keep rates higher for longer. The Russia/Ukraine War, the escalating Middle East issues and the political melees in Washington have twisted the burner toward “high.”

Sell-offs like this make far too many folks fearful. And make them want to take action – any action, since doing something creates the comforting illusion of control.

And in markets like this, that emotion-triggered “doing something” usually takes the form of selling.

But investing moves driven by emotion – not facts, your overall strategy or your long-term goals and game plan – can be characterized by two words.

A mistake.

A big mistake. And one that, if echoed over and over again, could end up as a (financially) fatal mistake.

Emotional moves like this mean you’ll end up selling when you should be buying – or at least standing pat.

You’ve already heard it at IDD … and you’ll hear it over and over again: Be a Wealth Builder, not a Wealth Killer.

Don’t dive in and out of stocks. Don’t speculate with options.

And Wealth Builders are what they are because of “time in the market … not timing the market.”

Want proof?

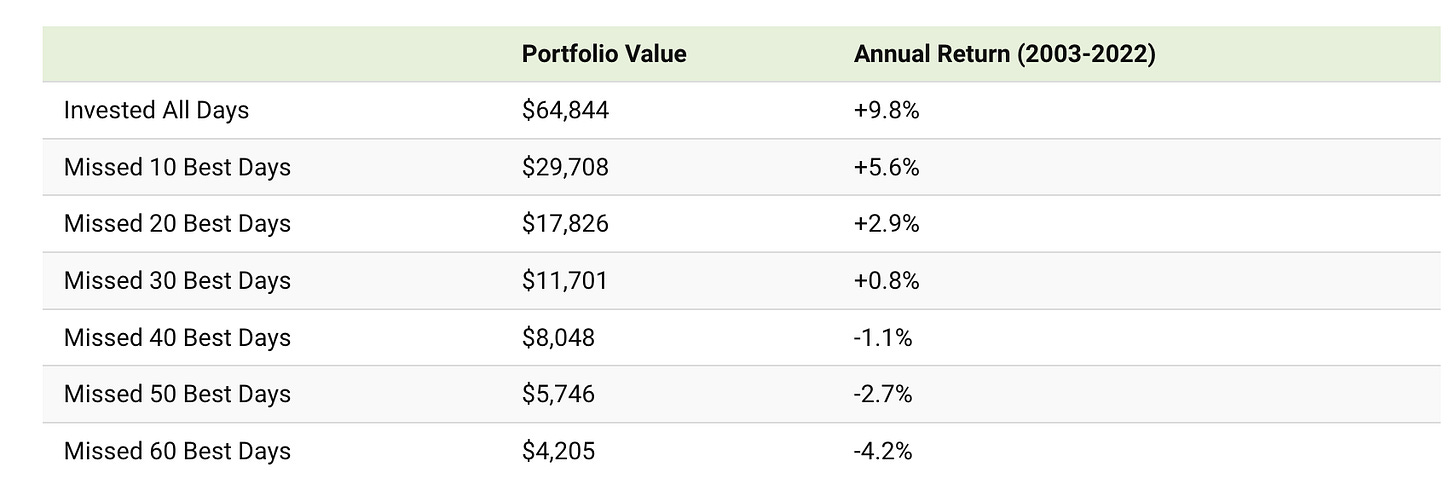

Take a careful look at the chart below and how it works out for people who try to time the market:

If you put $10,000 in the S&P 500 in January 2003 and just let it sit there until December 2022, that $10,000 would have grown into $64,844.

But, by trying to time the market, you end up on the sidelines at the worst possible (and most-costly) moments.

And the more “best days” you missed, the less money you made – and the further behind you fell.

In fact, by missing the 40-60 best days people actually lost money.

Just take a look at the annual returns below:

Now, watching your account take a hit for a few days, weeks, months, or even a year or more is painful to watch.

But that pain is triggered by fear. And fear leads to mistakes – like trying to time the market and missing the best days to have been invested.

And that is how you become a Wealth Killer.

The solution to that is to put time on your side and stay invested in the most powerful storylines that lead to the most powerful profits.

Bill’s Investing Takeaway

“If you take one thing away from today’s issue, it should be this: The long run is where real wealth is made.

But long run doesn’t mean ‘buy-and-hold forever’ (though it can).

And it (definitely) doesn’t mean you play ‘day trader’ with stocks or options, moving in and out of shares at will.

We want to help make you a Wealth Builder.

Wealth Builders follow a blueprint.

They don’t succumb to pessimism like this – they just look for opportunities.

They make time their ally.

And they understand that, over time – as the charts here today illustrate – stocks move higher.

I drilled into this ‘how to deal with a sell-off strategy’ in a recent issue of Stock Picker’s Corner (SPC).

Check it out here … for free.”