Wendy’s Surge-Pricing Snafu: How to Dodge the Inflation Hammer

Plus, the “great disconnect” between good data and dour outlooks and why the fine print matters on your high-yield savings account …

In this issue of Investing Daily Dose (IDD):

🍔Wendy’s fumbles its AI foray.

👀Why the latest reports fail to tell the full inflation story.

💵And double check that payout on high-yield savings accounts.

From “AI” to “Ay Yi Yi”

To offer discount specials and upsell nudges (so you add a Frosty and Baconator Fries to that Dave’s Double With Cheese on your next drive-thru visit), fast-food chain Wendy’s Co. WEN 0.00%↑ is investing $20 million and a splash of AI technology in its digital menu boards at all company-operated U.S. restaurants by the end of 2025.

Wendy’s pitched digital menus as a growth plan – increasing order accuracy, boosting upsells and opening the door to something the company tagged as “dynamic pricing.” And that term ignited a firestorm.

Big media groups like NBC News took “dynamic pricing” to mean “surge pricing” – like when ride-sharer Uber boosts prices during periods of higher demand. For Wendy’s and its still-new CEO Kirk Tanner, the response wasn’t good. Consumers were outraged. U.S. Sen. Elizabeth Warren (D-Mass.) called it “price-gouging plain and simple” and said that “American families have had enough.” Burger King cashed in at Wendy’s expense, “roasting” them on X and offering Whopper discounts for the rest of the week.

Wendy’s backtracked, including a clarification statement to NBC News, saying surge pricing wasn’t part of its plan.

Bill’s Investing Takeaway

“This leadoff story about Wendy’s is the first of three stories that link together today – call it an ‘IDD Trifecta.”

A big reason for the blowback was in the lackluster way that Wendy’s detailed its message. Consumers are already suffering from cumulative-inflation fatigue – and this story at first appeared to be a case of ‘price-gouging’ or ‘piling on.’

Heck, even my son – a high-school junior with a part-time job – was affected. We had stopped at the store after his hitting practice, and were walking out to the truck, when Joey said: ‘Did you hear about Wendy’s new surge-pricing plan?’

Lost in the media dust-up was the fact that Wendy’s is using AI as part of its plan. It will be interesting to watch what the chain actually does here. I happen to like their burgers, spicy chicken sandwiches and Frosty desserts. So I’ll be watching this plan.

Having said that, there are two other eatery chains whose forays in to AI tech have been chronicled at our Stock Picker’s Corner (SPC) publication. The first is McDonald’s Corp. MCD 0.00%↑. And the second is Wingstop Inc.(WING).

The Great Disconnect

If the latest economic reports were a painting, that portrait would be one of an economy that’s really pretty strong. For example:

✅Inflation is down year-over-year from 6.4% to 3.1%.

✅GDP clocked in at 3.2% in the fourth quarter, cruising past expectations of 2%.

✅The S&P 500 crossed the historic milestone of 5,000 mark on February 9.

✅And unemployment is under 4% and has been since January 2022.

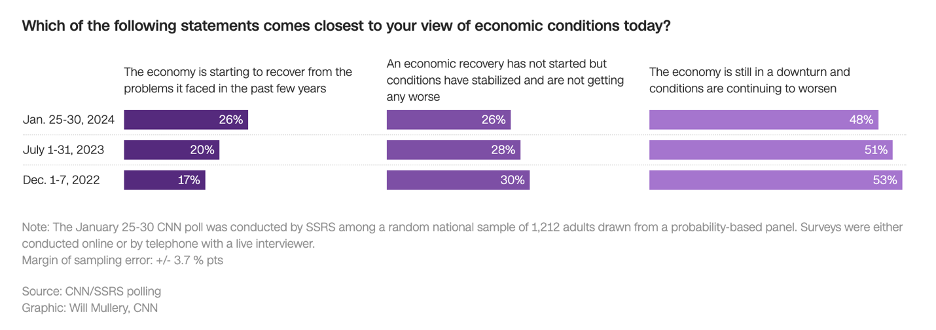

Those numbers paint that positive picture. But a CNN survey – and others like it we’ve seen of late – tell the opposite story. Only 35% of those surveyed said the American economy was “doing well.” A full 48% say the economy is in a downturn, and believe that conditions are worsening – not much of an improvement from the 51% of folks who had that same dour view in July 2023, or the 53% who were downbeat in December 2022.

And of all the folks who say the economy is getting worse, half attribute their pessimism to the cost of living/rising prices/inflation, CNN said. This is truly a “Great Disconnect” between perception and reality.

Bill’s Investing Takeaway

“It’s an interesting day here at IDD, since our first story (Wendy’s surge pricing snafu) actually ties closely into the second (the Great Disconnect) which then ties to the third (which follows below).

The Wendy’s saga relates to this one because folks viewed it as ‘surge pricing’ … and perceived it to be a plan by the burger chain to charge more during periods of high demand.

The anger this all generated was instructive … and proved something we’ve already been saying here at IDD: Consumers aren’t looking at the ‘latest inflation report.’ That’s a mere snapshot.

They’re looking at cumulative inflation – prices that are up 20% across the board since the pandemic, and more than 18% since January 2021.

When you break out specifics, it gets even more painful. Car insurance … up 44%. Gas … up 35% … groceries are up almost 21%.

Heck, we haven’t spent this much of our paychecks on food since 1991.

The bottom line here is that there’s lots of pessimism. And pessimism is one offshoot of uncertainty: The less control you feel that you have, the worse you feel. The answer is to take back control … at home, at work and with your money.

With your investments, three things will help:

Get Growth: Find companies and investable storylines whose stocks that mesh well with your goals and feelings about risk.

Generate Income: Think it terms of ‘cash flow’ … a flow of money from your passive investments that can maintain your standard of living and even serve as the ‘raw material’ for additional stock investments. And when you pick income plays, be sure to factor in taxes, market rates and inflation.

Think Long-Term: We’re not talking about ‘buy-and-hold forever.’ We’re looking at five, seven or 10 years – to help you navigate whipsaw stretches and maximize your gains.

Check That Asterisk on High Yields

Those high-yield savings accounts may not be as high of a payout as you think. As the Federal Reserve went on a “hike-at-all-costs-campaign" from March 2022 to July 2023, banks pumped up yields on savings accounts.

One New Jersey man – profiled in the Wall Street Journal report “When High-Yield Savings Accounts Come With an Asterisk” – assumed the 1.81% rate he received when opening his account would keep rising in lockstep with market rates – especially when he saw the bank advertising accounts with higher yields. Except ... the bank was rolling out nearly identical savings offerings every few months (we say “nearly” since the product name was changed a bit each time). But customers eventually realized that their pre-existing, older accounts did not pay them those higher-advertised yields.

Source: WSJ.com Take the New Jersey saver, who’d signed up for a product simply called “Savings” with that previously mentioned 1.81% yield. A few weeks later, “Rewards Savings” was advertised with a 2.21% yield. “Savings” members didn’t receive that higher yield.

The WSJ cited many examples of folks who’d been treated just the same way – frustrating since they wanted to do the right thing – generate income.

Bill’s Investing Takeaway

“This ‘dose’ rounds out an ‘IDD Trifecta’ of three reports that all fit together.

Consumers, unfortunately, look at income in all the wrong way.

In the report cited above, they didn’t read the fine print. Which, I’m sure was made intentionally complex.

Most income investors also ignore crucial bits of context, like tax brackets, market rates and interest rates.

They fail to think about the actual ‘cash flows’ they’ll receive.

And income is an important element of wealth-building. If you haven’t already, check out our income report with an ‘income opportunity’ for your investing research list here.”