Olivia and Noah are the most popular baby names in 2024, but two other “names” will be more important for investors: Ozempic and Zepbound.

These weight-loss drugs are the next big “blockbusters” in the biotech realm … blockbusters that can pack an extra punch for your portfolio.

Dose No.1: Weight-Loss Drugs

What’s Happening

Goldman Sachs recently predicted the market for weight-loss drugs would zoom from about $19 billion last year to $100 billion by 2030.

You’ll see those sales start ramping up here in 2024, as the percentage of U.S. employer health plans covering weight-loss drugs jumps from 25% to a projected 43%.

Why It Matters

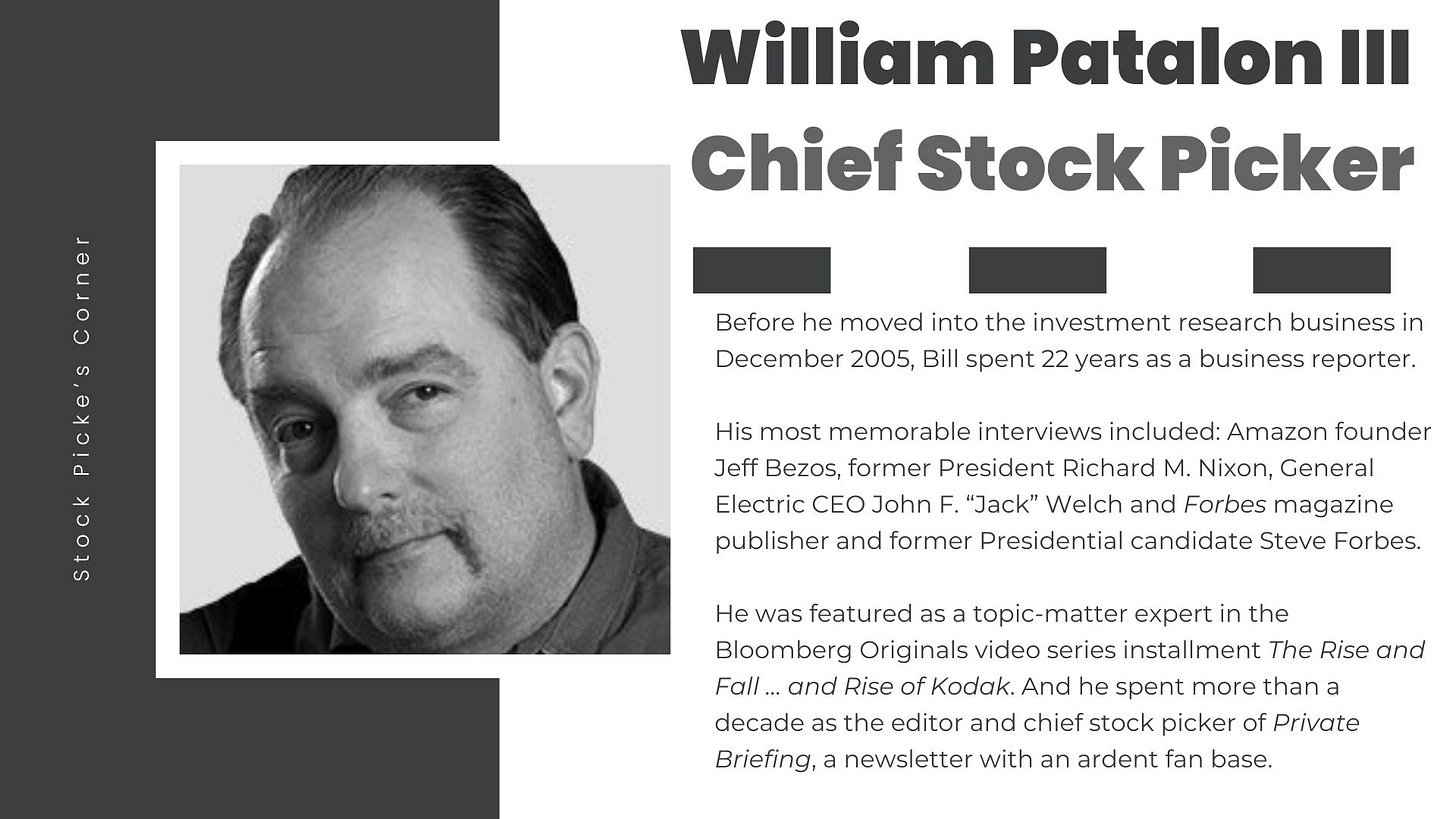

IDD’s chief stock picker, Bill Patalon, spent years covering the biotech sector — first as a journalist and then as a newsletter editor and stock picker — so he understands how the game is played. Because it takes 10 years and as much as $2.6 billion to develop a new drug, Big Pharma and biotech companies have a vested interest in maximizing the revenue from all their new discoveries.

In a strategy known as “label expansion,” these companies develop a drug to treat one malady — but have a massive incentive to uncover new uses for each new drug they get approved. We’re seeing it now with the Novo Nordisk NVO 0.00%↑ drug Ozempic.

While originally developed for people with Type 2 diabetes, Ozempic demonstrated a potentially beneficial side effect: Weight loss.

One study found that, on average, patients on Ozempic lost 5.9% of their body weight in three months. In six months, people lost 10.9% of their body weight.

Now sales for Ozempic are booming.

Those sales nearly doubled from $4.76 billion in 2021 to $8.44 billion in 2022. In 2023, Ozempic sales topped $13.9 billion.

Eli Lilly & Co. LLY 0.00%↑ generated $5 billion last year with its own diabetes drug — Monjouro — and won approval for a weight-loss version, Zepbound, in December 2023.

Once the “Ozempic” secret was out last year, patients had trouble getting orders filled. Both Novo and Eli Lilly say they’re ramping up capacity, with Lilly specifically investing $4 billion to build two new plants in North Carolina. And Novo just announced plans to buy New Jersey contract manufacturer Catalent, a $16.5 billion deal that will give the Danish Pharma giant more production capacity.

With the additional health-plan coverage and boosted consumer awareness, Novo and Lilly will need the extra capacity. And when you have supply ramping up to meet pent-up demand for a hit product that’s zooming toward “blockbuster status,” you’re looking at a massive potential stock-price trigger.

Bill’s Investing Takeaway

“I spent years covering biotech, and know full well what a wealth generator blockbuster drugs can be.

My early call on blood-cancer biotech Pharmacyclics handed subscribers of my previous newsletter, Private Briefing, an 818% windfall when that company was bought out by AbbVie Inc. (ABBV) a few years later.

I understand “Biotech Math.” And I understand the “label-expansion” incentive that will lead to these drugs getting new-and-profitable uses.

And I know how rare an opportunity it is for retail investors to invest in the earliest stage of a runaway “blockbuster” drug like this one. Here you’ve got a major wealth window that’s keyed to one of the big storylines I’m following. Don’t miss it.”

Dose No. 2: Buffett’s Baseball Swing

What’s Happening

Warren Buffett’s Berkshire Hatahway Inc. (BRK.A, BRK.B) bought $8 million worth of Atlanta Braves Holdings Inc. BATRK 0.00%↑ shares near the end of 2023.

Why It Matters

For the “Oracle of Omaha,” thanks to his $121 billion net worth, that outlay of $8 million is like you or I buying a cup of coffee (the 7-Eleven kind, not the Starbucks kind).

In short, that $8 million is pocket change.

BATRK is a spinoff from Liberty Media Corp. LSXMA 0.00%↑. And Buffett owns stakes in other pieces of the Liberty family lineup, so the Braves play doesn’t come out of left field.

But at IDD we followed and carefully studied the Atlanta Braves Holdings as a spinoff, which added muscle to our conviction factor for this “special-situation” investment idea.

What really has us stoked is how the spinoff makes it easier to sell the team — if/when that time comes. At a 2022 investor meeting, Liberty Media CEO Greg Maffei said that “if, somewhere down the road, the team is ever to be sold, we can avoid corporate-level tax.” Maffei then added that “we have no plans to [sell], but the opportunity for an investor to purchase or come and look [emphasis ours] is probably cleaner now.”

But if the higher-ups receive an offer, they may pounce on it.

“If [Liberty Chairman John Malone] gets a big bid on the Braves, he’s going to sell it,” Jon Boyar, principal at Boyar Value Group, said in a 2023 interview. “And he’s going to sell it for a lot more than $39 per share … This is non-emotional, it’s cold-blooded capitalism.”

Sports franchises don’t pop up for sale often. So when they do, the buyer pays up – big time.

Bill’s Investing Takeaway

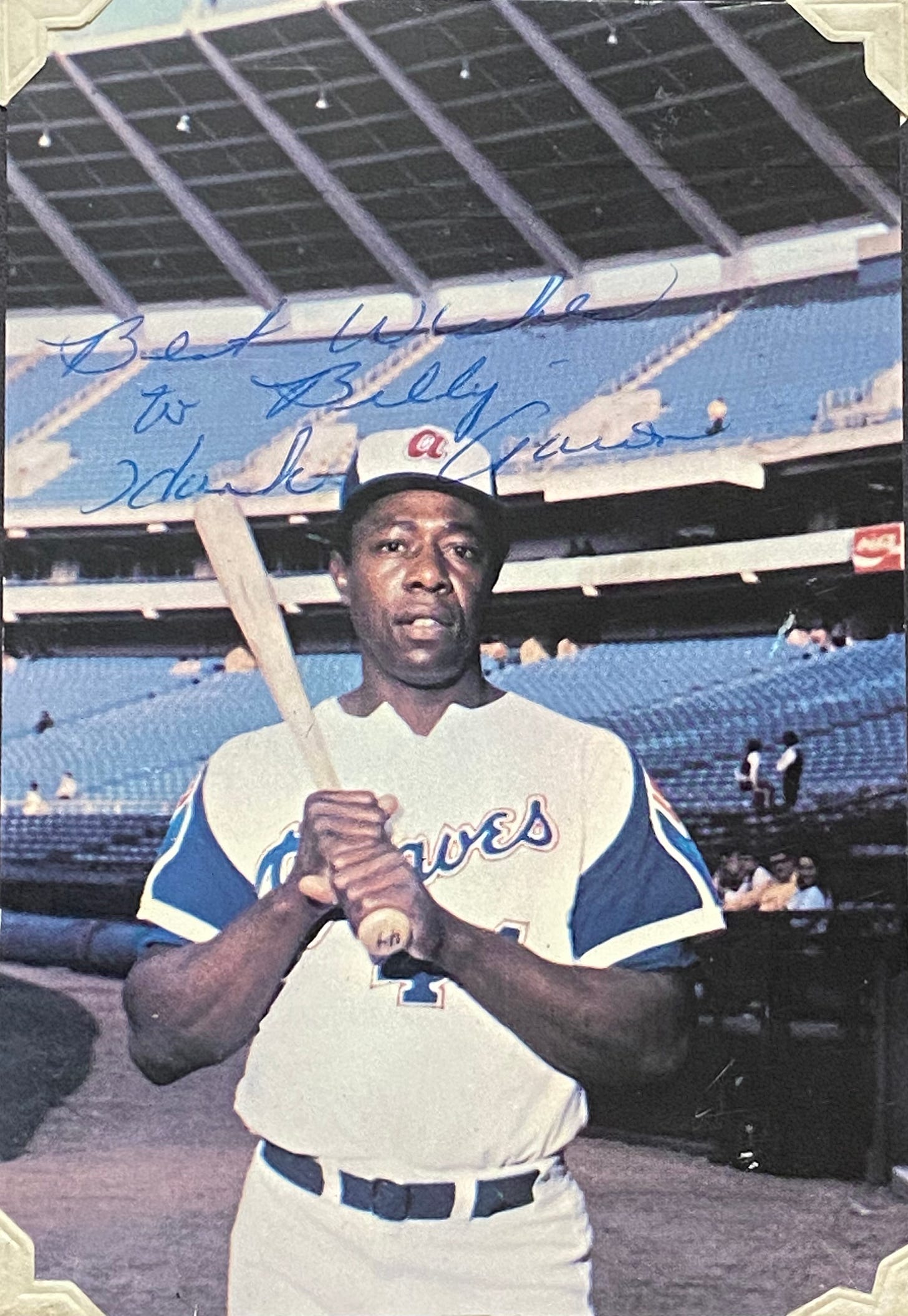

“I have to admit … there’s a sentimental aspect to this storyline for me … I still have the autographed picture of Hank Aaron that Atlanta sent me when I wrote to the team as a kid back in 1972.

And as someone who’s followed baseball for decades, I know the power of the Atlanta ‘brand’ — it built a massive national fan base when games were broadcast on the TBS ‘superstation’ for more than 30 years starting at about that time.

But the real ‘takeaway’ here — the one I want you folks to remember — is the power of ‘special-situation’ opportunities.

Spinoffs. Financial-engineering (share buybacks and dividend boosts). Buyout deals. And more. If you can spot the opportunities, you can reap the benefits. Which can be huge. And, in the case of the Atlanta Braves, also fun.”

Dose No. 3: “Greatest Silver Bull Market of our Generation”

What’s Happening

Peter Krauth, author of The Great Silver Bull: Crush Inflation and Profit as the Dollar Dies (Disclosure: As an Amazon Affiliate, we may earn commissions from qualifying purchases on Amazon.com) and the publisher of the only silver-focused newsletter, Silver Stock Investor, says we’re entering the “greatest silver bull market of our generation.”

He quantifies that with a price prediction, expecting the price of silver will skyrocket to $300 an ounce.

For you math-a-holics following along at home, that’s a gain of more than 1,000% from where silver trades right now.

Why It Matters

Bill has known Peter for more than a decade. And Peter has researched, written about and invested in silver and related resources for more than 20 years — using his extensive industry network (and home base in resource-rich Canada) to uncover outstanding opportunities.

As a well-known and respected precious-metals expert, Peter is also a frequent guest contributor to webinars and financial websites such as Kitco and Forbes.

So when he’s made such a bold prediction, your moneymaking radar should start beeping.

You can hear more from Peter in one of his most recent silver updates in the video below:

Bill’s Investing Takeaway

“Aggressive predictions of this magnitude intrigue me because, when you study the reasons behind them, you’re often rewarded with other moneymaking investment plays … or pathways to profit.

And I’m a proponent of using silver to augment your other stocks and income holdings.

Silver can be a hedge … a safe-haven … can give you some ‘peace of mind’ … and can ‘stack’ profits for you, too.”