In this issue of Investing Daily Dose (IDD):

👑Dividend Royalty Snapshot of the Week No. 2👑

Welcome back to our series on Dividend Aristocrats in the ProShares S&P 500 Dividend Aristocrats ETF NOBL 0.00%↑.

Earlier in the week, we showed you that higher prices are here to stay, underscoring that a passive-income strategy is an essential piece of a Wealth Builder’s game plan.

Once again, those higher prices hit us all in the face this morning, as the Consumer Price Index (CPI) showed prices for March rose more (3.5%) than expected (3.4%).

That’s why we’re featuring three different stocks in the ProShares S&P 500 Dividend Aristocrats ETF’s holdings, to help you develop your own passive-income strategy.

You can catch up on the start of the series here, and the first “snapshot” in this series is on AbbVie Inc. ABBV 0.00%↑, which you can access here.

Today, your next snapshot is ready.

Stock: Walmart Inc. WMT 0.00%↑

Founded: 1962

10-Year Average Stock Price Gain: 10.63%

Dividend & Yield:83 cents (1.37%)

To start off, since we’re talking about the importance of generating income, Walmart’s dividend payout is quite modest, paying out 83 cents for a yield of 1.37%.

That’s something to keep in mind if you’re looking for higher-yielding income stocks.

But you also need to look at the full picture.

Walmart isn’t just a “Dividend Aristocrat” – a company that’s boosted its dividend for at least 25 years in a row.

It’s a “Dividend King” – companies that have boosted their payouts every year for at least half a century. And, for Walmart, that includes its most recent dividend increase, where the payout was boosted by a hefty 9%.

In addition, analyzing Walmart requires a look at the “total return,” where income and capital gains are viewed together.

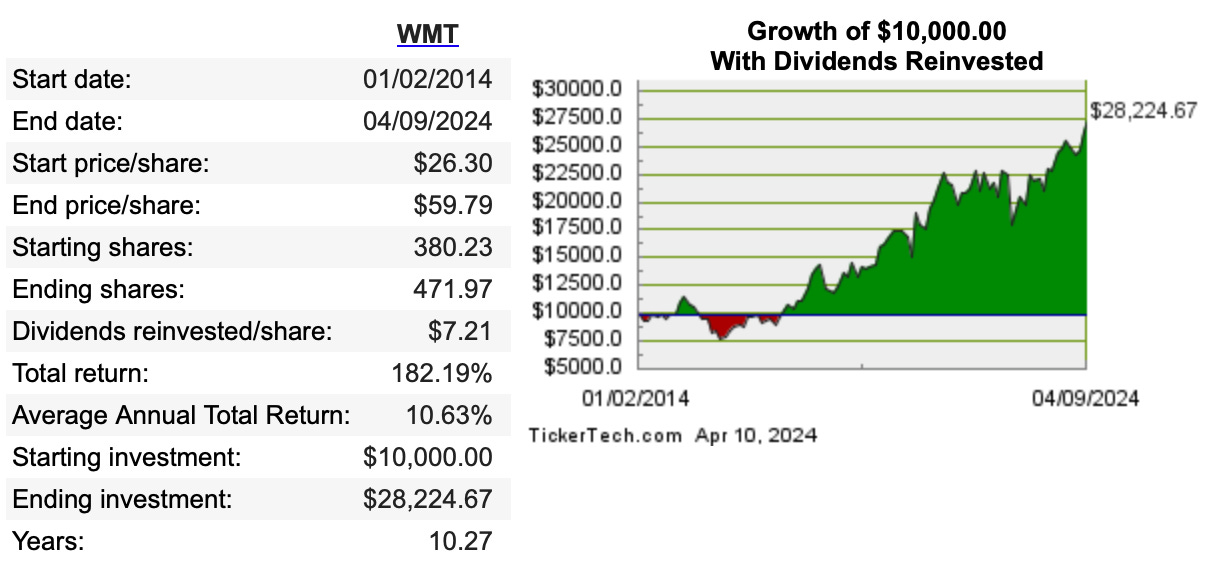

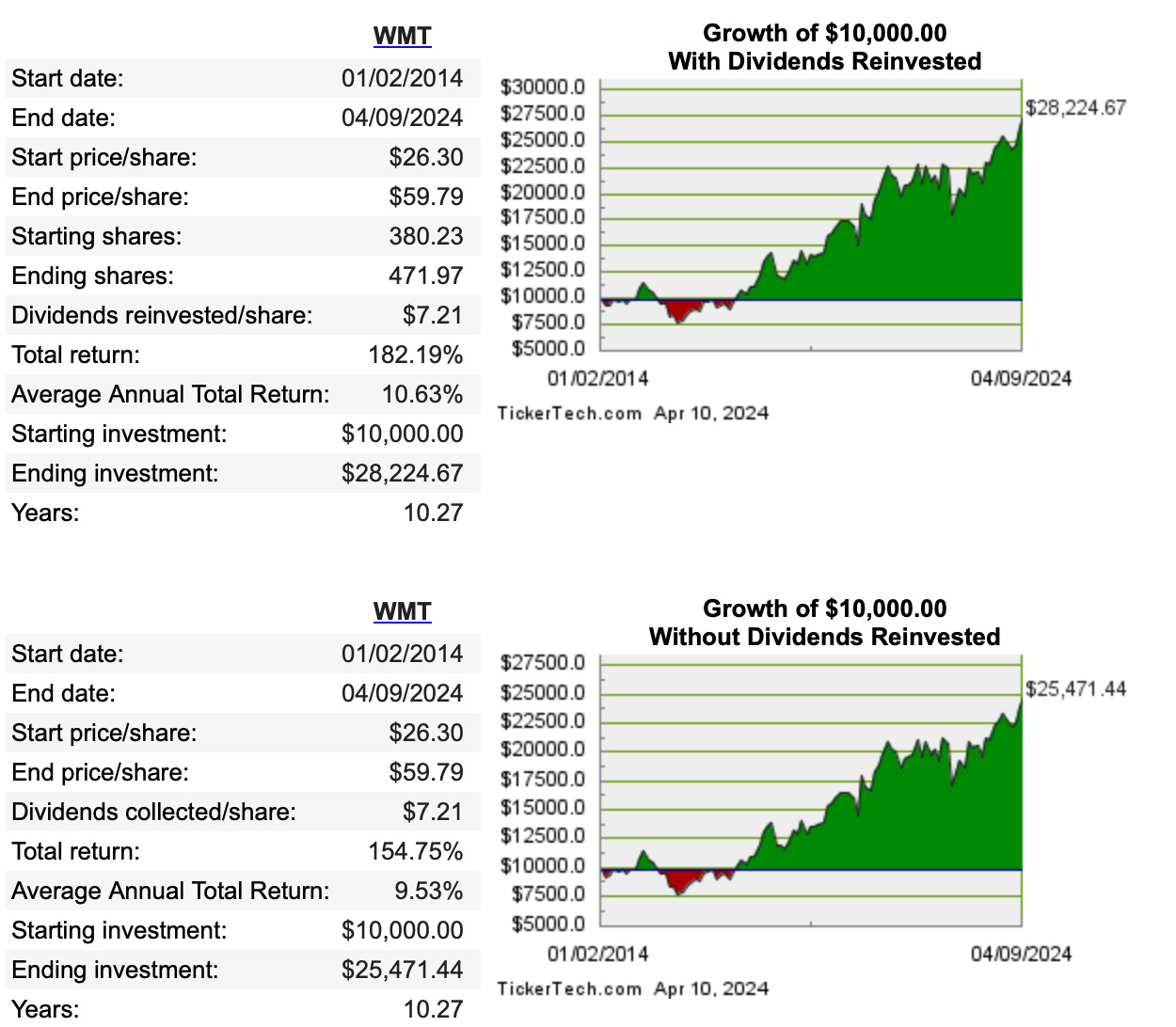

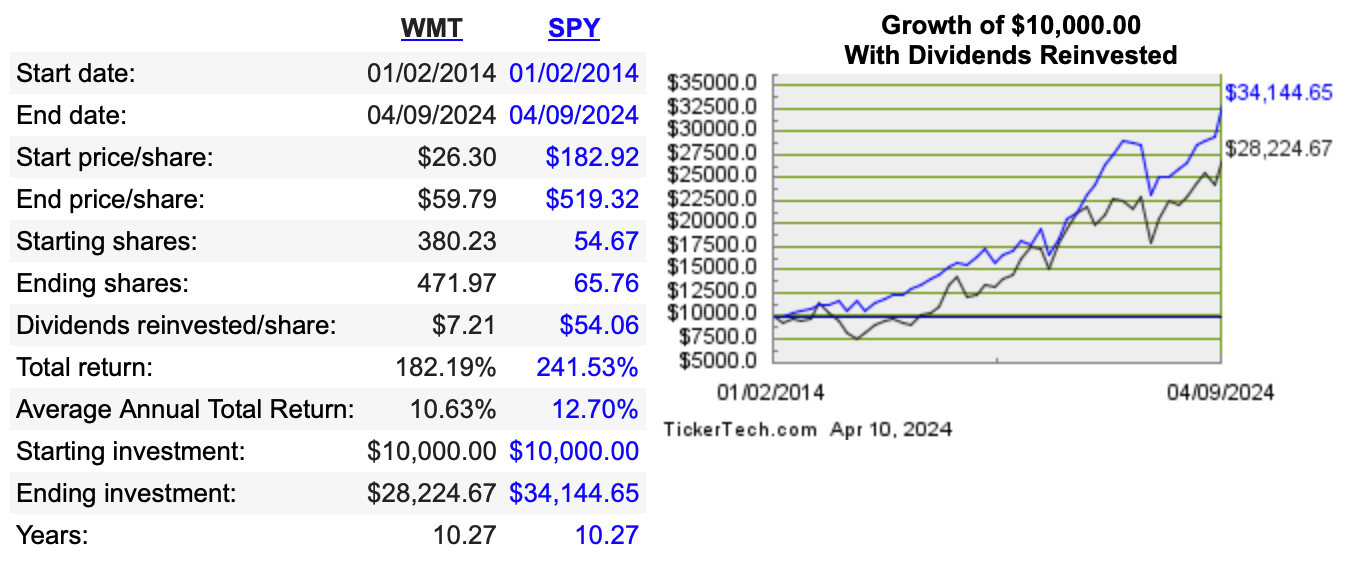

Just take a look at these charts from DividendChannel.com, comparing Walmart’s total returns – with dividends reinvested (a 10.63% return) or dividends pocketed and not put back into the stock (a 9.53% return):

Now, to weigh all the factors of Walmart as an investable opportunity, that 10.63% total return comes in a distant second compared to the S&P 500’s 10-year average return (with dividends reinvested) of 12.70%.

In other words, you would have lagged the market if you bet on Walmart.

But the stock market is all about what comes next, which is why we want to zero in on two opportunities for Walmart:

1. Reeling in a bigger slice of the high-income crowd.

2. And its $2.3 billion deal to buy TV manufacturer Vizio.

“Save Money, Live Better”

CFO John Rainey said in the company’s last earnings call that “one of the biggest contributors in the quarter was in this income demographic from households that make more than $100,000 a year."

Rainey continued: “For general merchandise as an example, two-thirds of the share gain that we had in the quarter was through this income demographic and digital channels.”

Some may say cooling inflation would be a threat to this newly-won-over clientele, but remember that the Federal Reserve’s goal is to slow how fast prices are rising – not to stop them from rising.

And it certainly won’t make things cheaper.

The reality is that just about everyone in America is feeling the squeeze. And with 90% of Americans living within 10 miles of a Walmart store, America’s largest retailer has a good shot at adding more high-income earners to its shopping ranks.

Consumers – at all earning levels – hate to overpay for things.

To bolster that point of finding the best deals, on that same earnings call, CEO Doug McMillon said that Walmart's prices for general merchandise, which includes products like clothes, toys and electronics, are lower today than a year ago.

That’s because Walmart is what’s known as a “channel commander” in the retailing world. Walmart is such a dominant player – and product makers want so badly to get space on its store shelves and on its website – that the retailer has a kind of “reverse pricing power” and can push back on price increases.

It can even put the squeeze on manufacturers and exact price cuts.

That leads us to Walmart’s next opportunity.

More Than a TV Acquisition

On February 20, Walmart said it would buy Vizio for $2.3 billion.

But as Axios detailed in a recent report, this is a deal that tightens Walmart’s grip on consumers. It’s not just about TVs or electronic gadgets, it’s about advertising – and owning the message.

“Walmart spent $2.3 billion last week to buy Vizio, a manufacturer of televisions. Not because it wants to manufacture televisions, but because it wants to sell advertising. Vizio is at heart a media company masquerading as a manufacturer. By owning Vizio, Walmart can continue to monetize the TVs it sells long after they've left its Supercenters.”

Once you’ve bought a Vizio TV, all you need is a WiFi connection to start streaming shows.

Vizio offers free and paid services, and in return for being showcased on the TV, those services share their revenue or ad slots with Vizio.

In the last quarter of 2023, Vizio brought in $174 million and made $105 million from its advertising and content-distribution deals. We’re talking about a 28% jump in revenue and a 27% surge in profits year over year. Ad sales themselves rose a scorching 36%.

In 2023, Walmart’s ad business, Walmart Connect, generated $3.4 billion in revenue. In comparison, Amazon.com Inc. AMZN 0.00%↑ hauled in nearly $50 billion in ad revenue.

Generating more ad dollars is a big opportunity for Walmart.

If the acquisition clears, it’s also a data goldmine.

And here in the AI Era, data is the “currency of the realm.”

Overall, it’s a compelling, long-term opportunity, as selling TVs transforms from being a one-time sale into recurring revenue for Walmart.

The key here will be Walmart’s execution.

Vizio is playing from behind to catch up with other streaming-enabling providers with its 18 million active accounts. Roku, for example, surpassed 80 million accounts at the end of 2023.

Amazon’s Fire-TV device sales topped 200 million accounts as of March 2023.

This also isn’t Walmart’s first foray into the video-streaming world, purchasing the platform Vudu in 2010 for $100 million.

In a move that seemed to signify Walmart wasn’t ready to acquire an entertainment streamer, it turned around a year later and flipped Vudu to NBC Universal’s subsidiary Fandango for an undisclosed amount.

Walmart will have the rarest of opportunities with Vizio – a second chance.

Bottom Line: As a retailer, the risks Walmart faces are already known: heavy competition and slowdowns in consumer spending because of economic turmoil. Looking ahead, it also has two promising growth opportunities. With a modest dividend yield of 1.37%, you’ll find higher payouts from other Dividend Aristocrats – like the 3.44% yield from AbbVie. Walmart is better viewed as a “total-return” investment – with capital gains and dividends viewed in total. And while those total returns have lagged the broader market over the past decade, Walmart’s growth projects and its recent higher dividend increase dangle bigger potential going forward.

Tomorrow, the next “aristocrat” we’ll spotlight is the kind of business that Warren Buffett loves – and one that was key in helping him build his $138 billion fortune.

We’ll see you then.