Why the Quickest Car in History Makes Us Bullish on Tesla

In this issue of Investing Daily Dose (IDD):

The power of the “Musk Ecosystem.”

The “Oracle of Omaha” hands out more investing gems in his 59th shareholder letter.

And how long it takes for the stock market to reward patience.

The Quickest Car … Ever

Elon Musk has reiterated his plan for a new generation of the Tesla Inc. TSLA 0.00%↑ Roadster sports car, saying it’ll be shipped (🤞) in 2025 – and billed it as a collaboration between Tesla and SpaceX.

The headlines are focused on Musk’s prediction that the new Roadster will zoom from zero to 60 mph in less than a second.

The Dodge Challenger SRT Demon 170 (and its 0-60 time of 1.66 seconds) is billed as the quickest car in the world. The Dodge Demon has an internal-combustion engine – a supercharged Hemi V-8 that makes 1,025 horsepower. That bit of info isn’t to get all technical. The point is that the Tesla Roadster is an EV. So any such “dethroning” would also represent a “changing of the guard” of sorts.

The headlines are mainly focusing on the Roadster’s $50,000 down payment and $200,000+ price tag.

But that’s not the real story here.

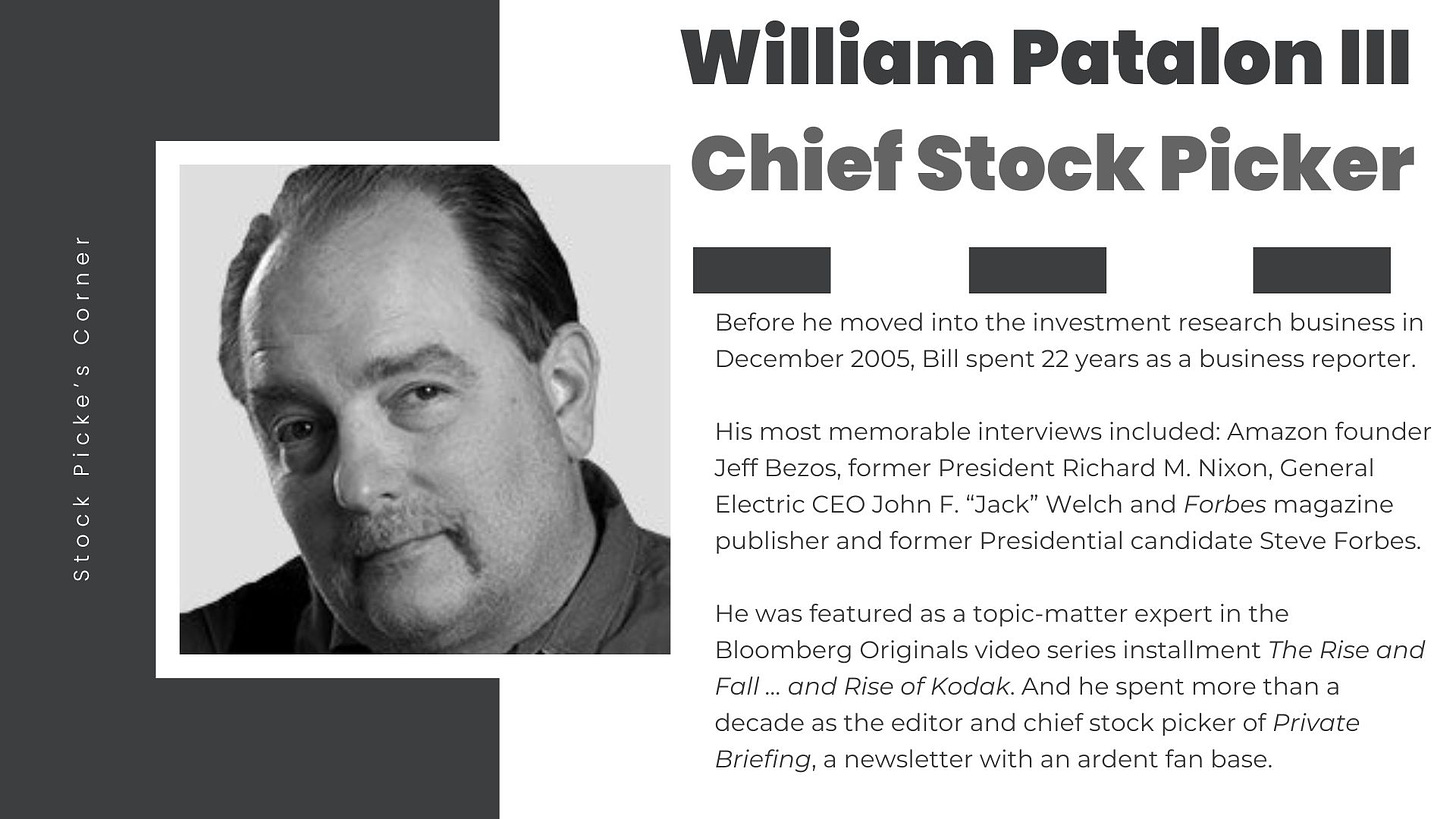

Bill’s Investing Takeaway

“Musk’s hyperbole aside … this a big deal – because of the collaboration between Tesla and SpaceX.

Here at IDD, we love ‘ecosystem’ companies. An ecosystem is what Musk is trying to build. And that’s what this Roadster deal represents.

We’re talking about a family of companies where he can leverage the knowledge, equipment, processes and data … across his ventures.

That’s the ‘Musk Ecosystem’ in action. And the power of that perhaps isn’t adequately reflected in most current assessments of Tesla’s upside.

In an investor presentation last year, Musk mused about a hypothetical 80% profit margin for Tesla as its advanced tech and automation processes hammered down costs. Run the numbers on that … and the upside potential for Tesla’s shares could be massive.”

Buffett Wants Real Investors – Not Lottery-Ticket Holders

In his latest annual letter to shareholders, Berkshire Hathaway Inc. (BRK.A, BRK.B) CEO Warren Buffett eulogized his longtime business partner Charlie Munger, who died in November at 99 years of age, called out today’s stock-market gamblers – and yet again reiterated the fundamental but powerful investing strategies that create wealth.

Throughout IDD and Stock Picker’s Corner (SPC), Bill talks about “Wealth Builders” and “Wealth Killers.”

Buffett is the quintessential “Wealth Builder,” amassing his $132 billion fortune with investing rules that are powerful because they’re simple.

Rules like:

✅Invest in what you understand.

✅Buy businesses, not stocks.

✅Have a long horizon to own those shares – with “forever” being the ideal holding period.

✅And invest – don’t gamble.

Bill’s Investing Takeaway

Our team has talked about the ‘DraftKings Mindset’ that’s taken hold in the financial markets … a gambling mentality that looks at stocks and options as ‘entertainment’ or ‘bets.’

For those folks, the tenets talked about by Buffett are viewed as boring, out-of-touch or irrelevant.

Not here.

Our goal is to help our folks build wealth. To educate, advocate and elevate opportunities and strategies focused on that single goal. And today’s ‘Dose No. 3’ goes right to the core of our mindset.

If you’re interested in a Buffett investment that hasn’t received a lot of media coverage but still has a lot of upside, check out ‘Dose 2’ in this issue.”

A Profit-Peaking Stocks Strategy

In his must-read book Same as Ever (Disclosure: As an Amazon Affiliate, we may earn commissions from qualifying purchases on Amazon’s website), author Morgan Housel says that research shows that for holding a stock, the “most convenient” time horizon is “probably around 10 years or more.” Take that approach and time becomes a competitive advantage. It revs up the compounding engine. And it mitigates the fallouts from mistakes – which are inevitable … we all make them.

In the chapter he calls “Too Much, Too Soon, Too Fast,” Housel demonstrates how stocks pay off big when you put time on your side but inflict pain when you’re in a hurry: “A good summary of investing history is that stocks pay a fortune in the long run but seek punitive damages when you demand to be paid sooner.”

Bill’s Investing Takeaway

“It’s fascinating to read Buffett’s shareholder letter and Housel’s book back-to-back.

Because the fundamental message is almost exactly the same. With good reason.

Time is a competitive advantage for individual investors.

That longer horizon runs counter to the casino mindset I’ve watched take hold the last few years.

That longer holding period is how you can outfox Wall Street … It’s how you can cement your own future … and create generational wealth for your family.

It’s the one strategy that puts you in a position to win.”