In this issue of Investing Daily Dose(IDD):

👑Dividend Royalty Snapshot of the Week No. 3👑

Today concludes our “grand tour” inside the ProShares S&P 500 Dividend Aristocrats ETF NOBL 0.00%↑.

You can catch up on the start of the series here, and see our other two “snapshots” in the links below:

· AbbVie Inc. ABBV 0.00%↑: Snapshot available here.

· Walmart Inc. WMT 0.00%↑: Snapshot available here.

Here in this third-and-final installment, we’re featuring a Dividend Aristocrat that has increased its dividend payout for 41 consecutive years – meaning it’s approaching “Dividend King” status as a company that’s boosted its dividend for at least 50 years in a row.

Stock: Aflac Inc. AFL 0.00%↑

Founded: 1955

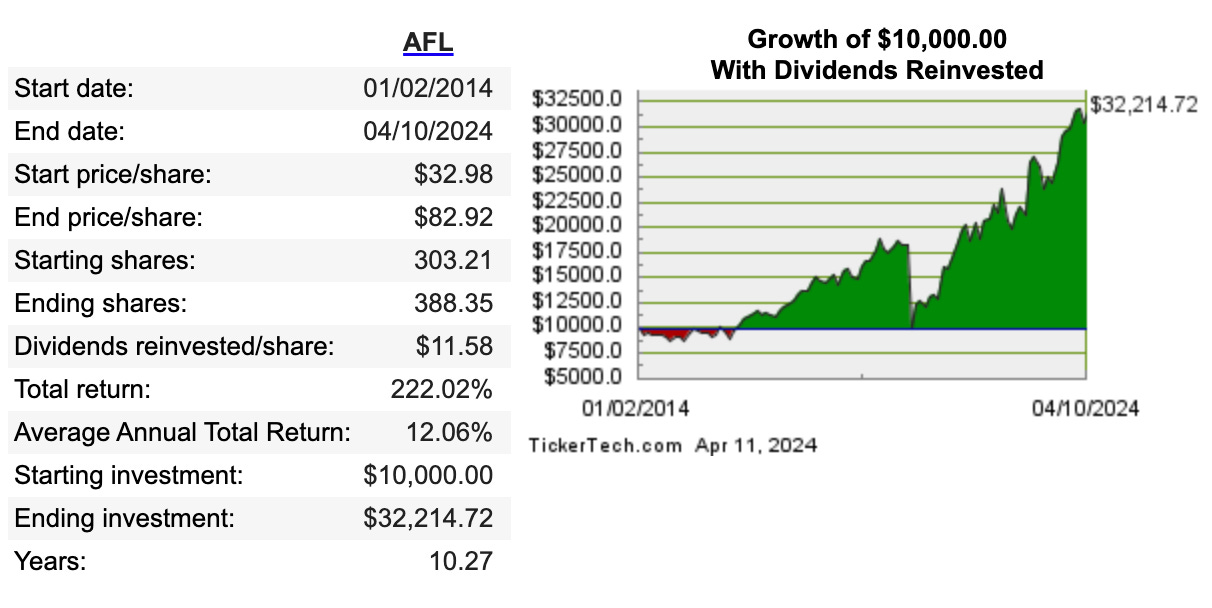

10-Year Average Stock Price Gain: 12.06%

Dividend and Yield: $2 (2.41%)

The Quack Known Around the World

The Georgia-based Aflac is the No. 1 U.S. provider of “supplemental” insurance – policies that help you pay out-of-pocket expenses not covered by your “major-medical” policies.

Insurance like:

Warren Buffett loves insurance companies because of the so-called “float” – the premiums they collect but haven’t paid out.

That money can be invested in different ways – to hopefully – generate a profit.

Aflac enthusiastically uses its “float” for such “financial-engineering” strategies as stock buybacks. That’s a way for a company to funnel its cash flow to shareholders: By repurchasing shares, the company’s earnings are allocated across a smaller “float” – which can magnify its earnings per share (EPS).

Aflac bought back $2.8 billion worth of shares in 2023 and has board authorization to purchase an additional 77.7 million shares going forward.

The other way to funnel cash flow to shareholders is via dividends – one source of the passive income we advocate here at IDD.

In the first quarter of this year, Aflac hiked its payout by a hefty 19%.

During a stretch where unpredictability and instability seem to be the watchwords, Aflac offers the opposite: With a tenure that’s reached 34 years and counting, CEO Dan Amos is the fifth-longest-tenured CEO of a Fortune 500 company, having been in the driver’s seat since 1990. That’s nearly five times the seven-year average of a Fortune 500 CEO.

During his tenure, he has increased Aflac’s revenue sevenfold.

In addition, his list of accomplishments includes testing the “Aflac duck” commercial, which took Aflac’s brand recognition from 11% in 2000 to 94% by 2014, according to Aflac.

But when considering any investment, you should look for holes in the “investment case” you’ve created – to make sure you’re putting your cash into a Wealth Builder and not a Wealth Killer.

The biggest issue is in Japan, where the company makes 70% of its profits, according to a Fortune profile.

In 2023, 29.1% of Japan’s population was 65 or older, making it the world’s oldest population, according to the United Nations.

For the first time in 90 years, marriages in Japan also fell below 500,000, which is a potential problem: Low birth rates put the squeeze on the next generation of workers. The worry that there won’t be new workers ready to take over as older workers retire is such a hefty issue that Prime Minster Fumio Kishida said last January that the country is on the brink of not being able to function.

Some of those folks may cut back on some of their supplemental insurance and eventually will not need it.

If there’s a lack of new customers signing up in Japan, where such a heavy concentration of its business is done, that’s a threat.

And between 2022 and 2023, the top line shrunk:

Aflac Revenue 2022: $19.1 Billion

Aflac Revenue 2023: $18.7 Billion

Companies can increase earnings in the short run without top-line growth. But sustainability demands consistent revenue gains. Aflac may have to look elsewhere for growth – including acquisitions, which can be expensive and risky. And even successful deals can take time to integrate.

The Bottom Line: With a CEO who’s been steering the company since 1990, Aflac can count on steady leadership. And its shrewd use of its “float” allows it to turn cash flow into shareholder-friendly moves via buybacks and dividend increases. Its “aristocrat” status makes it likely the company will do whatever it can to stay on that course. There are challenges, however, with perhaps the biggest threat looming in Japan, where it’s got a concentrated business and an aging potential customer base. The dividend yield of 2.41% is higher than one of the other spotlighted companies this week – Walmart – but is lower than our other spotlighted company – AbbVie. Aflac’s next earnings report is expected to be released on May 1, meaning we’ll get a closer look at how the insurer is faring.

That wraps up our series on Dividend Aristocrats for the week.

Out of Abbvie, Walmart and Aflac, which stock would you rather own?

If you have another Dividend Aristocrat or a high-yielding dividend stock in your portfolio that’s treated you well, let us know in the comments.

We’ll see you next week.